Media Archive

Media Coverage

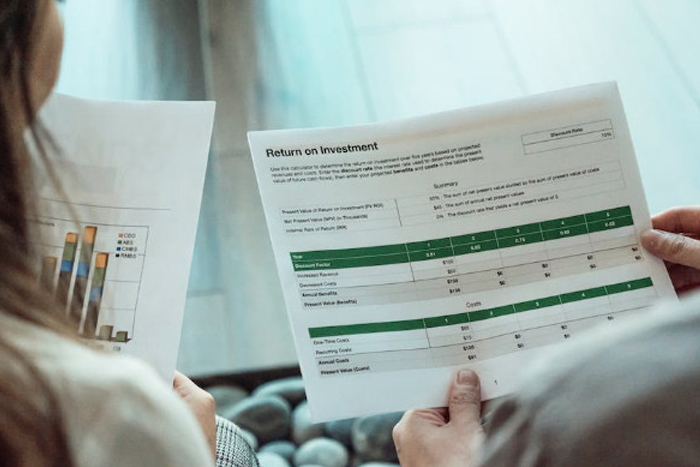

How Technology Is Reshaping Investing by Making Markets and Financial Literacy More Accessible

Linda Royer, CEO of VectorVest, Lule Demmissie, CEO – US of eToro, and Brie Williams, Head of Practice Management at State Street Global Advisors join Jill Malandrino on Nasdaq TradeTalks to discuss how technology is reshaping investing by making markets and financial literacy more accessible.

5 Top Income Investments for 2024

Income-producing investments play a pivotal role in a well-rounded portfolio, offering stability, cash flow and wealth preservation.

7 Best Funds to Hold in a Roth IRA

As 2023 winds down, savvy investors have another task to add to their year-end financial checklist: saving up for an upcoming annual Roth IRA contribution for 2024.

7 Best Vanguard Funds to Buy and Hold

For active investors, the path to outperforming the market is fraught with numerous obstacles and inefficiencies.

Treasury Strips (T-Strips): What They Are and How to Invest in Them

When thinking about U.S. government-issued Treasurys, many investors immediately consider Treasury bills (T-bills) due to their popularity and straightforward nature.

6 Best Health Care ETFs to Buy for 2024

Investors who are unsure, or even anxious, about the stock market heading into the last month of the year might want to check up on the health care sector.

Tesla’s Price Cuts Will Bring EVs To The Masses – What Does It Mean For The Stock?

Tesla’s precipitous price cuts on some of its models will bring electric vehicles (EVs) to the mass market, but it won’t help its shares, which remain overvalued.

How to Invest $100K for Retirement

Retiring on $100,000 isn’t an easy task, but whether that amount can last you through retirement will largely depend on how you invest and when you retire.

How to Become a Day Trader

Investing in stocks can move people closer to their long-term financial goals and generate extra cash flow.

Gen X Retirement Savings: Average Household Has Just $40K — Here’s How Much It Should Have

A recent article from Business Insider revealed a startling statistic — the average Gen X household has only about $40,000 saved for retirement.

Retirement Savings: Why Baby Boomer Portfolios Are Too Risky — And What To Do About It

As you age, many financial experts recommend reducing investment risk, such as by shifting away from stocks and more toward fixed income.

5 Signs Your Retirement Fund Will Last Until You Are the Magic Age of 80

Ensuring you have enough savings to last through retirement is a major financial goal. But for many retirees, the biggest concern is whether their retirement savings will last that long.

7 Best Funds to Hold in a Roth IRA

Millions of Americans today actively contribute to a Roth IRA, enjoying its myriad benefits and unique tax advantages.

I’m a Financial Planning Expert: Here Are 4 Investments To Make If You Want To Be Rich

What are the top investments to make if you want to be wealthy? It’s a question many people wonder.

7 of the Best Charles Schwab Mutual Funds

In the world of investing, brand loyalty can sometimes lead individuals to concentrate their assets with a single provider.

8 Ways To Become Rich If You Don’t Make Six Figures

Many people strive to earn at least six figures a year, believing such an amount is necessary for building financial stability or even becoming wealthy.

3 Simple Rules I Swear By To Build a Retirement Portfolio

Planning for retirement can be complex, but when it comes to establishing a portfolio that will see you through your retirement years, Jim Penna, manager of…

I’m an Accredited Investor: Here Are 6 Stocks I’m Buying This Fall

The seasons are changing, and so is your investment profile. With the arrival of fall, you’re planning to buy a few new stocks, but you’re not sure which ones to focus on.

63% Think Retiring at 65 Is Not Financially Possible: Here’s What Experts Have To Say

The average retirement age always seems to be on the rise. Part of the reason for this is that people have to wait longer than ever before to collect full Social Security benefits.

Retirement Savings: 5 Steps To Take Now If You Want a Comfortable Retirement

Retirement is a time of life that many eagerly anticipate, often with dreams of relaxation, travel and spending quality time with loved ones. However, ensuring…

Retirement Savings: 7 Things To Do Once You Officially Hit Your Retirement Goals

No matter your age, experts recommend that planning and saving consistently, as well as starting as early as possible, is the way to secure…

Retirement Savings: Why Gen Z and Millennials Are Opening More IRAs Despite Student Loan Crisis

For most folks, saving for retirement is not easy. Making sure the bills are paid can make it a challenge to save in the first place, and if you…

Will the Stock Market Crash in 2023? 7 Risk Factors

Rising interest rates and inflation have started to take a toll on the stock market.

7 Best Consumer and Retail ETFs to Buy Now

Investors can play defense and offense with these consumer- and retail-focused funds.

How Millennials Can Invest While Managing Student Loans

The student loan payment pause is rapidly coming to an end, and the first due date is set for October.

Yes, you can time the market

It has always been ironic to me that seemingly everyone on Wall Street says, “You can’t time the market,” and then proceed to make predictions about its future.

Should You Buy Palantir (PLTR) Stock?

AI and machine learning software pioneer Palantir has gained a foothold in the commercial and government markets. Is it a safe bet?

The Best Vanguard Money Market Funds

With less volatility than stocks, money market funds can be a safe haven during times of economic uncertainty.

Retail Investor Education is Critical

Investor education plays a crucial role in promoting financial literacy and empowering individuals to take control of their financial future.

Will the stock market rally continue in the second half of 2023? Experts weigh in

Wall Street rallied hard in the first six months of 2023, taking many market analysts by surprise.

7 Best Renewable Energy Stocks to Buy

International Energy Agency leader Fatih Birol said he wouldn’t invest his personal pension in fossil-fuel companies in an interview this week on the global news platform Semafor.

5 Best Consumer Discretionary Stocks To Buy Now

To put it simply: If you want to invest in a business that makes money, find the ones that buyers flock to.

Best Vanguard ETFs June 2023

Central to most Vanguard exchange-traded funds are two hallmarks: a passive indexing methodology and low fees.

Unlocking Generational Wealth: 8 Strategies for Long-Term Financial Stability

Generational wealth is wealth — often in the form of assets — that gets passed down to the next generation with the goal of creating opportunities and financial stability for one’s descendants.

Best Utility Stocks to Buy Now

Utilities are growing earnings at stronger than historical rates as they continue to ramp up investment to transform from fossil fuel to clean energy.

8 Best Utility Stocks to Buy for Dividends Now

For investors, utility stocks with dividends represent dependability in a tough economy.

How to Invest $10,000

Investing $10,000 can help you achieve your financial goals, whether you’re saving for retirement, buying a home or building long-term wealth.

7 ETF’s to Buy as Interest Rates Rise

Investing $10,000 can help you achieve your financial goals, whether you’re saving for retirement, buying a home or building long-term wealth.

7 of the Best ETF’s to Fight Inflation

Inflation can wreak havoc on a portfolio’s performance. Here are some ETF options to help fight it.

Portfolio Optimization Strategies: A Guide For Beginners

In its most technical sense, portfolio optimization is a mathematical system for determining the ideal basket of assets to maximize returns at a given risk level.

What Wall Street Is Missing About Apple And Google Stocks

Apple’s EVA is currently standing at 30.18%, up from 7% in 2017, while Google’s EVA is currently at 22%, up from 9% over the same period.

5 Best Investments for Retirees in 2023

Inflation is still very high, interest rates are set to rise again and talks about a potential recession have been picking up steam.

Video Archive

Market Launchpad Full Intro

Market Launchpad Intro

VectorVest Market Launchpad | Full

VectorVest Market Launchpad | :30

“I Want” VectorVest

Discover The Benefits

VectorVest Proof

Market Timing

VectorVest Mobile

Mobile Stock Picks

Mobile Timing

Netflix No Surprise from VectorVest

Money Makers 2021

Prove it – US – Looking Back

2020 Foresight

Timing the Market – Corona Crash

Discover the Benefits of VectorVest

I Want

Newsletter Archive

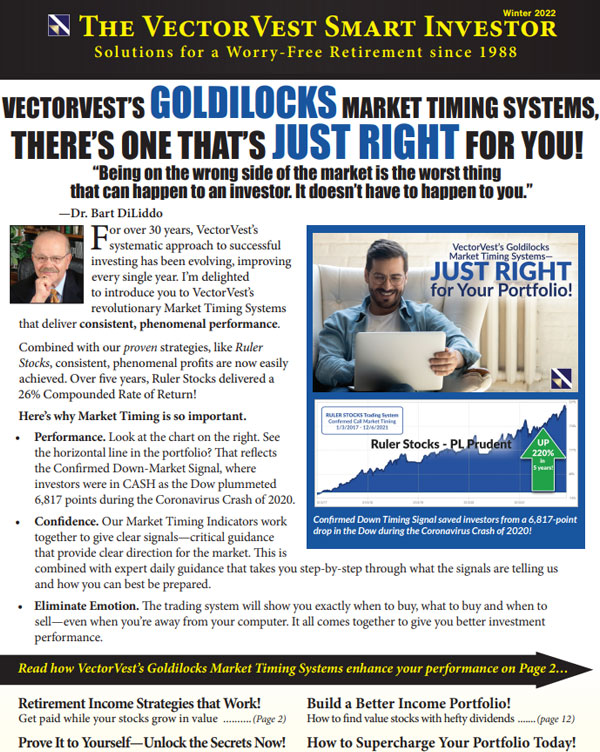

VectorVest’s Goldilocks Market Timing System, the DEW – Just Right for Prudent Investors!

Look at the chart below. See the last horizontal line in the portfolio? That is where the VectorVest DEW timing system took customers to CASH on 2/24/20, three days after the market high. >View Newsletter

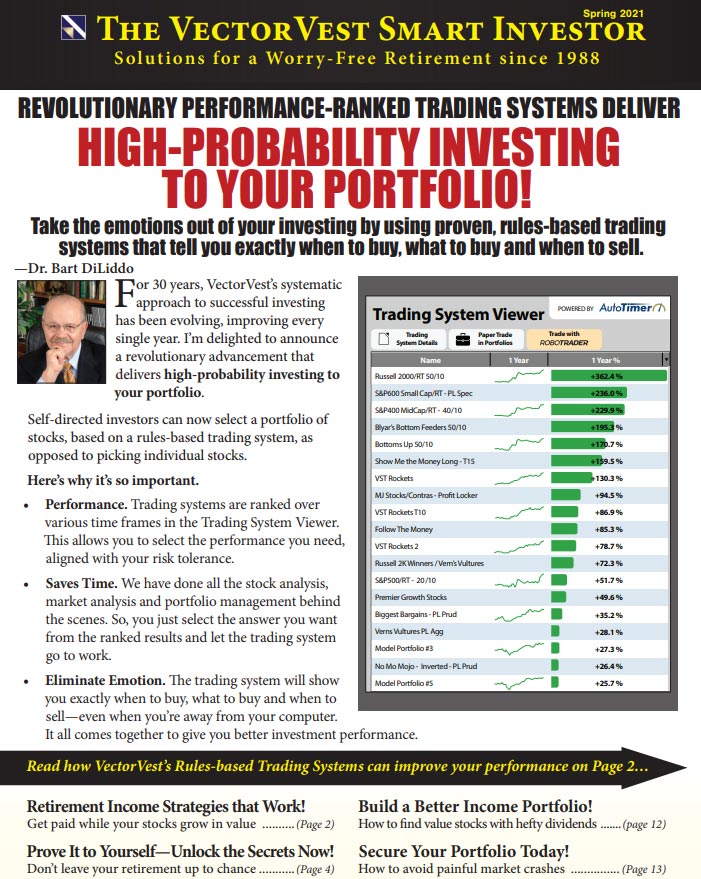

Supercharge Your Portfolio with the Trading System Viewer!

This amazing tool solves the biggest problems most of us have in selecting, implementing and sticking to a trading plan or system. >View Newsletter

[optin-monster-shortcode id=”tyfhdqgispobtbn5t8ev”]