Just a few weeks ago we talked about the backlash Target (TGT) faced as a result of their LGBTQ+ friendly line – and the subsequent pulling of that line from the shelves. And now, it’s becoming more apparent that the retailer faces another headwind on the horizon.

As the student loan restart is scheduled for September 1st, analysts fear that brands like Target will see a direct hit to their sales.

Millennials are the company’s largest customer – and this generation also happens to be the most heavily burdened with student loan debt. With less discretionary income to spend, individuals will be forced to make tough decisions as to whether they should shop with a premium retailer like Target or a more affordable alternative.

How much will the retailer be affected? That remains to be seen, but some analysts expect to see as much as an $8 million per month consumer outflow if all of this proves true. This would be a 1-2% headwind.

Target is also burdened by debt and will struggle to make payments as demand weakens. As a result of all this, analysts are changing their stance on TGT stock. For example, analyst Chris Horvers moved his price target from $182 to a mere $133.

The stock is down 20% in the past 3 months and shows no sign of turning things around anytime soon. So, is it officially time to cut losses on TGT stock – or should you weather this storm?

Here at VectorVest, we’ve analyzed the stock ourselves through our stock forecasting software to help you tune out all the noise and just get the insights you need. There are 3 other things you need to be aware of if you’re currently invested in TGT or are considering adding it to your portfolio…

While TGT Has Fair Safety, the Upside Potential and Timing Are Poor For This Stock

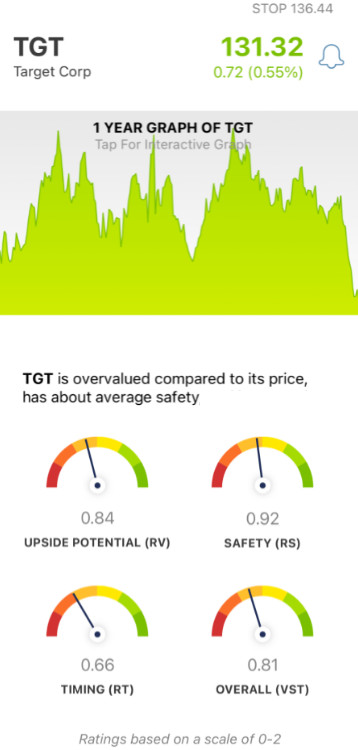

The VectorVest stock analyzing software helps you uncover winning opportunities on autopilot – giving you clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation so you can spend less time in front of a screen, all while boosting your success rate.

But, it gets even better – because based on the overall VST rating for a stock, the system gives you a clear buy, sell, or hold recommendation. As for TGT, here’s the current outlook:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation (projected 3 years out) to AAA corporate bond rates and risk. And right now, the RV rating of 0.84 is poor for TGT. Plus, the stock is overvalued right now with a current value of just $109.

- Fair Safety: While the RS rating of 0.92 is below the average, it’s still considered to be fair. This rating is calculated through a thorough analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The biggest challenge for TGT investors right now is the negative price trend that’s gripped the stock for the past few months – it shows no signs of letting up. The RT rating of 0.66 is poor and is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year

The overall VST rating of 0.81 is poor – but does that mean it’s time to sell this stock and move on to the next opportunity? Or, is there any reason to hold onto hope that things will turn around soon?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TGT, the stock has been battered by bad news recently – and while it has fair safety, the upside potential and timing are poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment