Monday morning’s trading session saw a big boost in Palo Alto Networks stock (PANW). The company is just a few short weeks away from joining the ranks of the S&P 500 index. And as a result, the stock is up 5% so far today.

The cybersecurity company is set to replace Dish on June 19th. Every quarter, the S&P 500 index rebalances its index in an effort to consistently reflect the best stocks in every sector. Palo Alto Networks will live in the Information Technology (XLK) sector of the index.

The stock has been in the midst of rallying over the past few months, and it sits 27% higher in the last 30-day period alone. This news will only bolster the strength of that trend. And if the company’s recent earnings and outlook prove true, Palo Alto Networks is set to finish the year strong. The company raised its full-year revenue forecast on May 24th.

CEO Nikesh Arora said that while economic headwinds don’t appear to be subsiding anytime soon, the company remains optimistic about its position. They’ve stayed heading by increasing deal scrutiny and sharpening the focus of the business’s value. By consistently producing a superior security solution for customers, the company will be able to withstand these challenging conditions.

Historically, being added to the S&P 500 index is a godsend to companies. After all, there is as much as $15 trillion benchmarked to the index. Being included means a company will be force bought.

And, it’s not just the S&P 500 index that sees potential in this stock. As many as 41 analysts have rated the stock a buy, with an estimated price target as high as $236. The stock currently sits at $228.

So far this year, PANW has outperformed the S&P 500 index with a 55% gain in the first 6 months of the year. Meanwhile, the index itself has grown a modest 11.5%.

With that said, does this stock deserve a spot in your portfolio too? We’ve taken a look at PANW through the VectorVest stock analyzer. And now, we have 3 things we want to share with you to help you make your decision with complete confidence and clarity.

PANW Has Good Upside Potential and Safety Alongside Excellent Timing

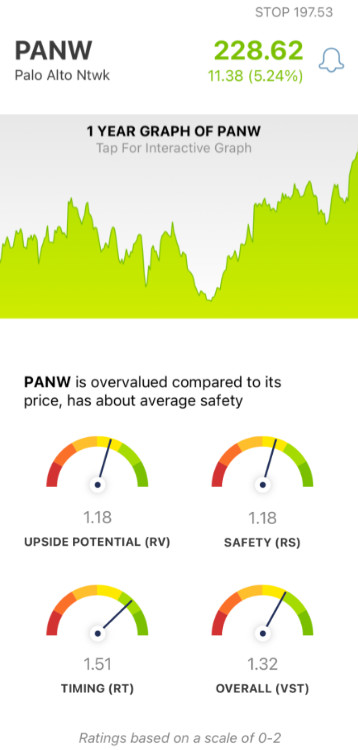

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Interpretation is quick and easy, as each rating sits on its own scale of 0.00-2.00, with 1.00 being the average.

But it gets better, because based on the overall VST rating, the system issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for PANW, here’s what you need to know:

- Good Upside Potential: The RV Rating is a comparison between a stock’s 3-year price appreciation potential alongside AAA corporate bond rates and risk. This indicator is far superior to a simple comparison of price and value alone. And right now, the stock has a good RV rating of 1.18. However, it’s worth noting that the stock is overvalued - with a current value of just $86.

- Good Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. And right now, the stock has a good RS rating of 1.18 as well.

- Excellent Timing: It’s clear that PANW has a positive price trend with the wind in its sails - and this is confirmed by the excellent RT rating of 1.51. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week, over week, quarter over quarter, and year over year.

The overall VST rating of 1.32 is very good for PANW - so does that mean it’s time to add this stock to your portfolio? If you already own it, should you pick up more shares and bolster your position before the stock is officially added to the S&P 500 index?

Get a clear answer on your next move with a free stock analysis at VectorVest. Don’t let emotion or guesswork get in the way of your investing strategy ever again!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PANW has good upside potential and safety, with excellent timing. The stock is set to be added to the S&P 500 index on June 18, and appears to be poised to finish the year strong - making it an attractive addition to your portfolio.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.