Lyft (LYFT) has been trending positively over the past few months, and CEO David Risher has decided to hop aboard with an insider purchase of $1.15m in company stock.

He flat out said, “I’m putting my money where my mouth is”. The purchase works out to 100,000 shares of the company’s common stock. Risher just took over this year and has been tasked with bringing down costs internally while also lowering pricing for riders in an effort to spur demand.

While insider trading of this nature is a common tactic CEOs and executives use to try and sway the stock in their favor through investor sentiment, Risher says that “This is the best investment I could make”. He says he expects the company to be very successful and wants people to know he has real skin in the game.

That being said, Risher does realize the mountain ahead he and the company have to climb in order to regain market share from Uber, the dominant ride-sharing company in the space. Still, he remains confident that the company is headed in the right direction with a strong team.

If the latest earnings for Lyft are any indication, so far, so good. Drivers that use both Uber and Lyft have started leaning towards the latter – with a 25% growth since 2022. It’s not all about drivers, though – it’s the riders that make the money. Fortunately for Lyft, active riders have reached multi-year highs as well.

In the most recent quarter, Lyft reported revenue of $1b, representing growth of 3% from last year’s quarter. To show you how challenging it will be for Risher and Lyft to overtake Uber, the competitor reported revenue of $9.2b – a 14% growth year over year.

All that being said, LYFT shares are trading nearly 36% higher over the past 3 months, and are up so far this week on news of Risher’s purchase. Where does that leave you, though? Should you buy shares of this stock too?

We’ve found 3 things that will help you determine your next move one way or another through the VectorVest stock analyzing software. Here’s what you need to know…

While LYFT Has Very Poor Upside Potential and Poor Safety, the Stock Does Have Very Good Timing

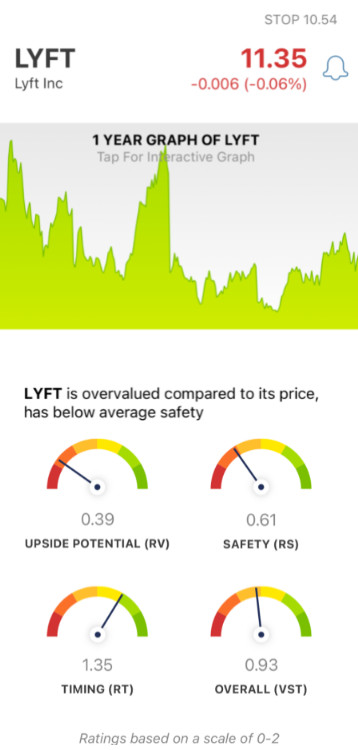

The VectorVest system simplifies your trading strategy by telling you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. But it gets even easier. Because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation at any given time. As for LYFT, here’s the current situation:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (3-year forecast) to AAA corporate bond rates and risk. And right now, LYFT has a very poor RV rating of 0.39. The stock is also overvalued at its current price, with a current value of just $1.85/share.

- Poor Safety: The RS rating is an indicator of risk, and takes into account the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for LYFT, the RS rating of 0.61 is poor.

- Very Good Timing: The one thing LYFT has going for it is the very good RT rating of 1.35 - which suggests a strong positive price trend for the stock. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for LYFT works out to just 0.93 - which is below the average but considered fair nonetheless. What does that mean for you, though? Is this stock a buy, sell, or hold today?

Get a clear answer through a free stock analysis at VectorVest today and execute your next move with complete confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While LYFT CEO David Risher is confident about the stock’s position and potential, the only thing it has going for it right now is very good timing. The stock’s long-term upside potential is very poor, and its safety is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment