One of the tech companies everyone was anxiously awaiting a 4th quarter earnings report from is Apple – and it came late Thursday. The company came up short of analyst estimates on multiple figures, and yet, the stock is up 4% in Friday morning trading.

Apple’s revenue took a hit in the final quarter of the year with just $117.1 billion compared to the expected $121.1 billion. The company also missed adjusted earnings per share at $1.88 vs the expected $1.94. And, the shortcomings don’t end there. The company fell short with Mac revenue and wearables, too. The only segments that performed as expected or better were iPhone, iPad, and Services.

Looking ahead to the future, Tim Cook and other executives within Apple gave a grave outlook. The company forewent March quarter revenue guidance once again, and the overall tone on the call was negative – with much concern over the challenging economic conditions to come.

So, out of all of this, how did investors find any reason to send shares trading 4% higher? There were a few wins worth pointing to. Demand in China is finally back on the rise after COVID lockdowns have subsided. This also led to a decrease in supply constraints that have served as bottlenecks to the company.

And, despite the unfavorable outlook ahead, Apple is expected to outperform its peers in the tech industry. As a result, many analysts maintained a strong buy rating on the stock – which is now up nearly 20% in the last month. Does that mean it’s time for you to buy?

VectorVest’s stock forecasting software can help you tune out the noise and provide a clear buy, sell, or hold recommendation based on a tried-and-true stock-rating system. Keep reading to find out your next move.

AAPL Upside Potential is Just Fair, but the Stock has Good Safety with Very Good Timing

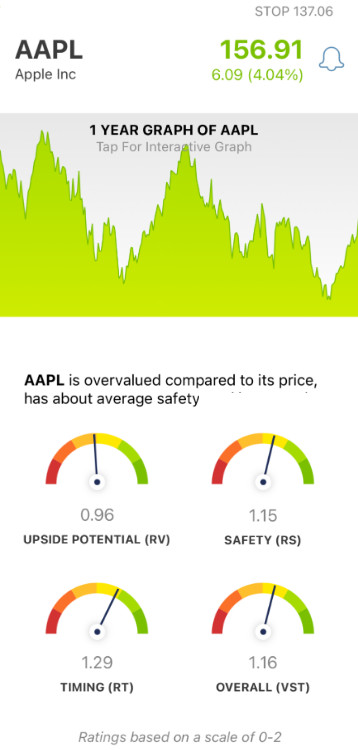

The VectorVest system tells you everything you need to know about an opportunity with just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). This makes stock analysis as quick and easy as possible - no matter your experience level. Each rating sits on a scale of 0.00-2.00, with 1.00 being the average.

And based on these three ratings, VectorVest is able to provide a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for AAPL, here’s the current situation:

- Fair Upside Potential: In comparing the stock’s long-term price appreciation potential to AAA corporate bond rates and risk, VectorVest deems the upside potential to be just fair - with an RV rating of 0.96. And, the stock is overvalued, with a current value of just $100.26.

- Good Safety: In terms of risk, AAPL has good safety with an RS rating of 1.15. This is based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: By looking at the past few weeks (or even months) for AAPL, you can see a positive price trend has formed - and the very good RT rating of 1.29 reflects that. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.16, which is good. But is it enough to earn AAPL a buy rating right now? Get a clear recommendation on your next move with a free stock analysis - you’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, AAPL is overvalued with fair upside potential, but it does have good safety and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment