It’s been a tumultuous 48 hours for WeWork (WE), as the co-working space provider has seen shares drop more than 45% in Wednesday’s trading session before recovering almost 38% so far in today’s (Thursday) trading session.

This was all put into motion after the company put out a warning to investors on Tuesday that expressed grave concern about the company’s future. Management says that “substantial doubt exists about the company’s ability to continue”. Clients are fleeing their co-working spaces and losses are piling up.

While the second quarter earnings report also contained plans to improve profitability and liquidity over the next year, the negative outlook was what Wall Street took away from the statement.

This is just the latest issue in what has been a brutal three-year run for WeWork as a publicly traded company. After IPOing at $10/share, the company has plummeted to mere cents on the dollar, losing more than 98% of its value since 2020.

There have always been red flags for WeWork in looking back at the company’s early days as a startup. From the eccentric founder’s skeptical dealings to the $10 billion bailout that SoftBank (the company’s primary investor at the time) had to pay – the signs that this company was headed for trouble have been clear as day.

And yet, WeWork is such a compelling story that it’s been the focal point of documentaries, tv shows, books, and more. That being said, the rally today has been a welcome sight for investors who have watched their position dwindle down to nearly nothing.

But, there is speculation that WE has been chosen as the next meme stock, as “you short, $WE squeeze” is trending online. Does that mean you should hold onto your position and hopefully ride the hype train higher and higher, recovering as much of your initial investment as possible? Or, is it time to get out with whatever you still can?We’ve taken a look at WE through the VectorVest stock analysis software to help you tune out the noise and make your decision based on a tried and true system – no guesswork, no emotion. There are 3 things you need to see…

Don’t Fall for the Meme Stock Hype: WE Has Poor Safety With Very Poor Upside Potential and Timing

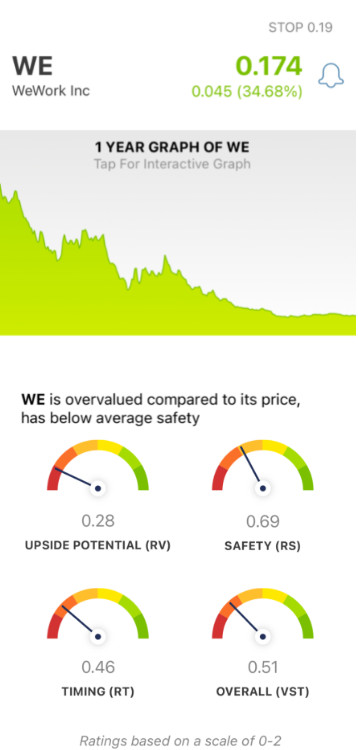

The VectorVest system simplifies your trading strategy, boiling down everything you need to know into 3 easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a simple scale of 0.00-2.00, with 1.00 being the average. This allows for effortless interpretation and empowers you to gain clear insights at a glance. But, it gets even easier. Because based on the overall VST rating for a given stock, you’re presented with a clear buy, sell, or hold recommendation. As for WE, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. As for WE, the RV rating of 0.28 is very poor. Even at a price of $0.17/share, the stock is overvalued - with a current value of just $0.02/share.

- Poor Safety: In terms of risk, this stock has poor safety - as evidenced by the RS rating of 0.69. This is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: Despite turning things around today, the timing for WE is still very poor - as confirmed by the RT rating of 0.46. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.51 is poor for WE - does that mean it’s time to cut losses or could this be a value buy? Don’t let emotion influence your decision-making. A clear answer awaits you at VectorVest - get a stock analysis free right now!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After raising concerns of the company’s future, WE has plummeted - and despite turning things around in the following trading session, the stock still has poor safety with very poor upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.