Thank you all so much for joining me today for the first episode of Fantastic Female Fridays. I really do apologise for the technical difficulties and we’re going to have a much better experience for you during the next part of the show that’s taking place just two weeks from now.

Of course, as promised, we re-recorded the session and you will find it right here:

In addition, I promised to share some resources with you to reflect on each of the three key things I talked to you about today.

First, the “Secrets of Women Investors” is a very interesting report about how women and men invest differently. It details a wide range of research across different timeframes that back up the conclusions that it arrives at. For example, it’s proven that women can outperform men in the market, be less knee-jerk reactive to issues in the short term and be more consistent with the strategy. If you would like to read more, the report is freely available to you from Kiplinger here.

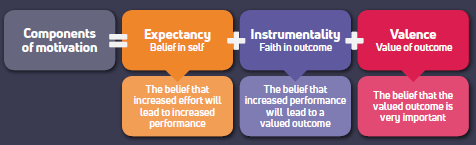

Next, I shared a model for motivation that I use for either putting the building blocks in place for my mindset to achieve what I’m striving for, or else, to figure out what’s draining my motivation. As you can see here, we need to start wondering if what we want is actually important to us. I gave the example of wanting to be able to invest in the market so that I could pursue a higher standard of living, or my definition of financial freedom. Then, I need to figure out the outcome that meets that value. For example, that might be buying some good quality stocks with a strong potential to make profits and distributing them to shareholders which leads me to solid returns. Finally, I need to a plan of action that I believe will get me closer to that outcome, i.e. set up a low-cost brokerage account, commit to watching this show every two weeks for 30 minutes and placing my first couple of trades.

Through taking actions that you believe will bring you closer to the things and experiences that you value, this is a clear way to build your confidence with your finances and other aspects of your life.

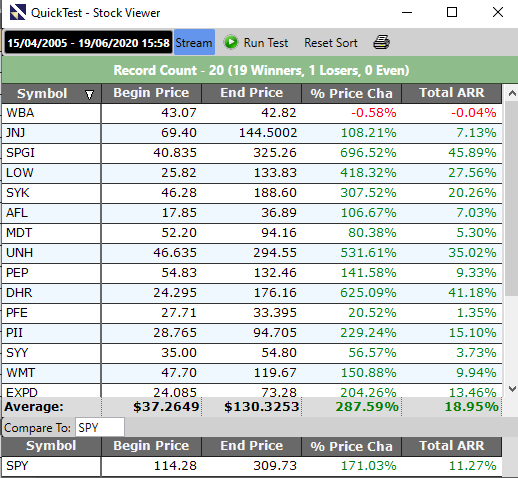

Finally, I wanted to share one specific strategy with you that focuses on exactly the things that we discussed today. How can you find good solid, safe stocks and transact as little as possible? The team at VectorVest designed the “Birthday Game”. Here is the way it works:

- On your birthday

- Buy the 20 safest stocks in the database (as measured by Relative Safety)

- Hold them

That’s it! Relative Safety measures consistency and predictability of earnings and dividends. By looking out for the stocks with the most consistent and predictable financial performance in the market today, you can easily find those companies who are more likely to offer solid returns with very few transactions over the long term.

I gave a couple of examples of my Birthday Game stocks and here is a screenshot of the performance I discussed:

If anybody would like to try out the Birthday Game for yourself, feel free to take a trial of the system.

One last thing! If you want to check out the Relative Safety measure of any stock, please do get a Free Stock Analysis report at https://qa.vectorvest.com/stockanalysis.

I really hope that you enjoyed our first episode, and our next one is taking place on Friday, July 10, at 12 noon ET on our YouTube channel. You can register at www.vectorvest.com/fff

Every best wish and thanks again,

Susan

(susan.hayesculleton@qa.vectorvest.com)

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment