Xpeng Inc. (XPEV) got a solid lift Tuesday morning after the Chinese EV maker delivered first-quarter results well above expectations despite challenges in the industry itself.

Sales came in at $907 million compared to just $573 million this time last year. Wall Street was expecting $859 million.

The company did report a loss of 10 cents per share, but this was much narrower than the 38 cents loss posted last year and the 33 cents loss analysts were forecasting. Profit margins got an 11% lift year over, getting closer and closer to break-even territory.

Co-president of Xpeng Brian Gu says that industry competition is fierce right now, but the smart EV business model being employed is unique enough for the company to stand out and gain market share.

Performance was solid not just in China either, but internationally. The company’s newest release, the X9 van, is pulling its weight with a steeper price tag of $55,000.

For the current quarter, Xpeng is expecting to move between 29,000 and 32,000 cars. This would signify a 25%-38% growth year over year, and bring the company to around $1.1 billion in sales – a 60% growth year over year.

This will make up for a drop in revenue per car, an important metric for the auto industry. Xpeng earned about $42,000 per car in this most recent first quarter, but will likely see just $35,000 per car in the second quarter. It’s worth noting this would still be an improvement YoY, as the company saw just $30,000 per car in Q2 2023.

The performance for Xpeng looks even more impressive in comparison to rival Li Auto, which delivered lackluster results yesterday and missed the estimates while suggesting slow sales growth going forward.

XPEV gained as much as 22% on the news today but has settled at around 8% now. The stock had a tough start to 2024 but has been rallying in the right direction in the past month – up 33% in that timeframe.

So, is it time to buy XPEV? Not so fast. We’ve taken a closer look at this opportunity in the VectorVest stock forecasting software and see 3 reasons to hold off for the time being.

XPEV Has Fair Upside Potential and Timing, But Safety is Poor Right Now

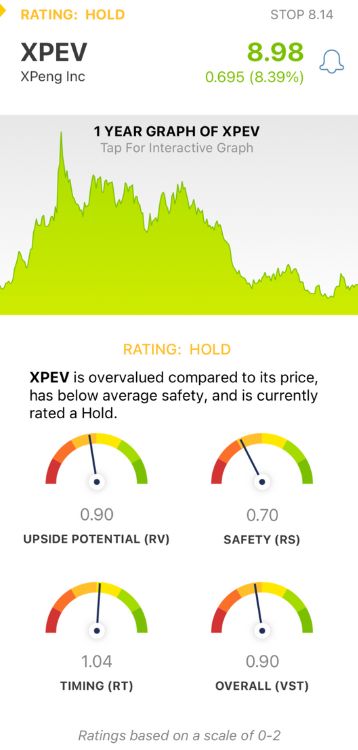

VectorVest is designed to save investors time and stress while empowering them to win more trades. It does this by giving you clear, actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though - you’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for XPEV:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. XPEV has a fair RV rating of 0.90, but the stock is overvalued at its current price. Current value is just $5.87.

- Poor Safety: The RS rating is a risk indicator. It’s computed from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. XPEV has a poor RS rating of 0.70 right now.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. This paints the full picture for investors. As for XPEV, the RT rating of 1.04 is fair. The stock has been trending in the right direction recently but is still down 37% YTD.

The overall VST rating of 0.90 is fair for XPEV, but not enough to earn it a buy. The stock is rated a HOLD for the time being.

That being said, we encourage you to take a deeper look at this opportunity yourself so you’re prepared to capitalize when the timing is right - get a free stock analysis today and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. XPEV over delivered in Q1 beating the consensus on both the top and bottom lines. The company expects to continue its performance in the current quarter, too - shares are up 8% on the news. However, the stock is still a hold as it has fair upside potential and timing with poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.