All eyes are on Volkswagen and Rivian right now, as just last week the two automakers teamed up to create an EV-focused joint venture. Volkswagen will gain access to Rivian’s EV technology and a heap of Rivian stock (RIVN) in exchange for up to a $5 billion investment.

Shares of RIVN are up 30% in the past week on this news, and they’re up 4% alone today. The electric automaker was in dire need of cash to work towards its profitability goals, and the infusion from Volkswagen came at the perfect time.

There has been doubt about where the company was headed, as profitability struggles have sent shares as much as 60% lower through 2024 just a few months back. The rebound is well underway, but RIVN is still down 30% YTD even after last week’s rally.

But beyond serving as a life raft to help the company reach its goals, the investment from a well-respected automaker like Volkswagen speaks to the quality of the EV technology Rivian is producing.

While some analysts have already raised their price targets – like RBC analyst Tom Narayan who bumped up from $11 to $14 – others still want Rivian to prove its worth.

The belief is that the upcoming R2 platform Rivian has been teasing could be the proof the market is looking for. It could potentially cut costs in half, solving the company’s biggest issue of profitability.

That said, the R2 vehicle will be lower priced as well, but this should help expand the reach and make the EV manufacturer’s offerings more accessible.

The stock sits at just $14.40 per share today, and the average price target on Wall Street has now risen $3 to $17 per share. Some analysts have pegged the price target as high as $21, though.

So, where does this leave you? Should you follow Volkswagen’s lead and invest in RIVN today? We’ve taken a closer look at this opportunity through the VectorVest stock analysis software and have 3 things you need to see before you make your next move.

RIVN Has Poor Upside Potential and Safety, But Excellent Timing is Pushing the Stock Higher

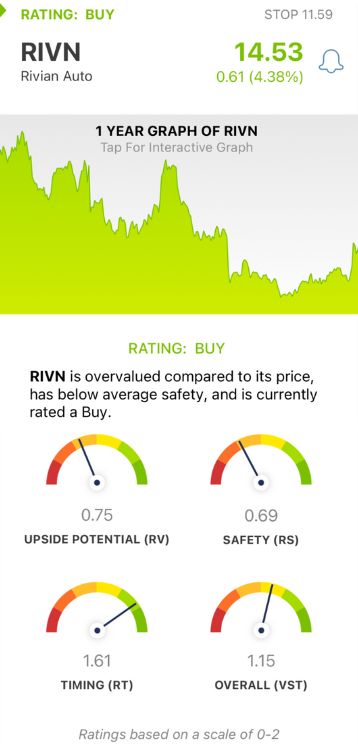

VectorVest simplifies your trading strategy by taking complex technical indicators and financial data and distilling them into just 3 ratings, which give you all the insight you need to make calculated investment decisions.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it actually gets even easier.

The system gives you a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. That said, here’s what we uncovered for RIVN:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than the typical comparison of price to value alone. As for RIVN, the RV rating of 0.75 is poor.

- Poor Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.69 is poor as well for RIVN.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. This is where things get interesting, as RIVN has an excellent RT rating of 1.61 after the stock’s recent rally.

The overall VST rating works out to 1.15, which is good for RIVN. The stock is currently rated a BUY in the VectorVest system. But before you do anything, take a closer look at this opportunity with a free stock analysis to make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RIVN has earned the Volkswagon endorsement along with a $5 billion investment, sending shares 30% higher in the past week. The stock itself has poor upside potential and safety, but excellent upside potential earns it a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment