The theme for the past year or so has been that Elon Musks’ focus on Twitter has resulted in the downfall of Tesla (TSLA). But, a recent trip to China to visit Tesla production plants has investors excited that the eccentric CEO is refocused on his automobile company.

The Shanghai Gigafactory plant is still “the heart and lungs of global Tesla production”, according to Wedbush analyst Dan Ives. The plant brings more than 80,000 units to market every month, which has given it a unique advantage over domestic competitors.

But, competition is mounting from the likes of BYD, Nio, Xpeng, and more – which signals a key turning point in the market. According to experts, Elon Musk’s first China visit in the past 3 years couldn’t have come at a better time for this reason.

With that said, the trip was more than an opportunity to visit plants and evaluate production. It’s been said that Musk is scheduled to meet key officials in Beijing. Companies like Tesla, Apple, and other US-based giants that source from China are walking a delicate tightrope as relations between the two countries continue to sour.

Should things escalate, these companies like Tesla stand to lose the most – production and expansion could slow to a standstill. Because of this, Musk is likely putting on his political hat in an effort to sway relations in the right direction while on Chinese soil.

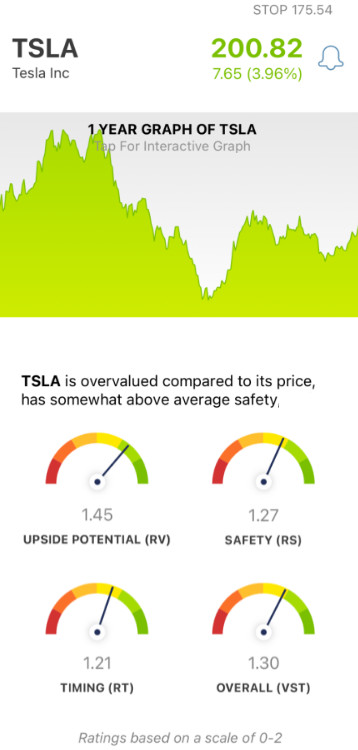

The news of this visit to China spurred a 4% jump in TSLA share prices, adding to what has already been an impressive rally over the past month. The last time we wrote about TSLA, the stock was coming off a low point of $108/share in January as Musk continued selling more and more shares. Today, it sits at just under $200 – with some experts setting a price target as high as $211.

So, have things finally turned around – is it time to start bolstering your portfolio with TSLA? We’ve taken a look at the stock through the VectorVest stock analyzing software and see 3 reasons investors can be excited about this stock…

TSLA Has Good Timing, Very Good Safety, and Excellent Upside Potential

The VectorVest system simplifies your approach to trading by giving you clear, actionable insights through 3 easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these ratings sits on a scale of 0.00-2.00 for effortless interpretation.

But, it gets even easier. Because based on the overall VST rating, the system issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for TSLA, here’s what we’ve uncovered

- Excellent Upside Potential: The RV rating compares a stock’s 3-year price appreciation potential to AAA corporate bond rates and risk. This makes for a far superior look at the stock’s upside potential than a simple comparison of price to value alone. As for TSLA, the RV rating of 1.45 is excellent. But, the stock is overvalued - with a current value of just $132.

- Very good Safety: The RS rating is an indicator of risk, and is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. Right now, TSLA has a very good RS rating of 1.27.

- Good Timing: As you can see by looking at how TSLA has moved over the past month, the stock has a positive price trend with the wind in its sails. As a result, it has a good RT rating of 1.21. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All things considered, TSLA has a very good overall VST rating of 1.30 - is it enough to earn the stock a buy recommendation, though? No need to play the guessing game or let emotion cloud your judgment. Get a clear answer on your next move with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After TSLA’s recent struggles, it’s starting to turn things around and head back in the right direction - climbing 57% YTD. The stock has good timing, very good safety, and excellent upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.