One of the biggest movers in this Wednesday morning’s trading session is Terran Orbital Corp. (LLAP). The company specialized in the development and operation of satellites, and just announced a huge contract with Rivada Space Networks. While shares have surged more than 60% by 11 AM EST, we’re still not sold from a pure stock analysis standpoint.

The $2.4 billion contract will have Terran Orbital building 300 total satellites for Rivada’s communication constellation. 288 of those will be in operation at any given time when the constellation launches in 2025, while 12 are spares. The contract also involves Terran Orbital developing portions of Rivada’s ground support channel.

Marc Bell – CEO, chairman, and co-founder of Terran Orbital – released a statement expressing his excitement for the opportunity to work alongside Rivada. And the deal couldn’t have come at a better time.

In the last year, Terran Orbital investors have watched the stock slide more than 72%. The company went public just under 2 years ago and has been on a steady trajectory toward the bottom since IPOing at $9.89. Today, the stock sits at $2.75.

But with the wind in its sails now, investors are wondering if Terran Orbital is worth adding to their portfolios. Despite the strong price trend that has formed as a result of this news, we’ve identified two issues with LLAP through the VectorVest stock analysis software.

Despite Excellent Timing, LLAP Has Very Poor Upside Potential & Poor Safety

The VectorVest system transforms your approach to uncovering and analyzing opportunities in the stock market. It tells you what to buy, when to buy it, and when to sell it - eliminating any guesswork or emotion from your strategy.

All of this is possible through the proprietary stock rating system VectorVest has engineered after decades of successfully outperforming the market.

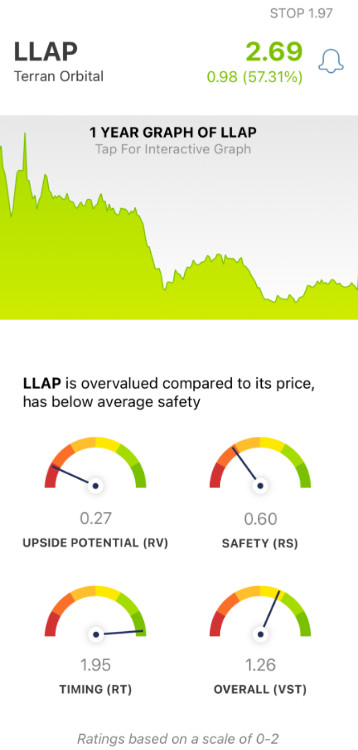

You’ll gain all the insights you need to make sound decisions in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate overperformance and vice versa.

Based on these three ratings, VectorVest is able to provide you a clear buy, sell, or hold recommendation at any given time, for any given stock: including LLAP. Here’s the current situation:

- Very Poor Upside Potential: Even with the whopping $2.4 billion contract secured, the long-term price appreciation potential for LLAP is very poor. This rating is calculated by comparing the stock’s 3-year price appreciation potential to AAA corporate bond rates and risk. And right now, the RV rating is just 0.27.

- Poor Safety: The RS rating is an indicator of risk and takes into account a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for LLAP, the RS rating of 0.60 is poor.

- Excellent Timing: Here’s where things get interesting - because the excellent timing for LLAP is undeniable. In analyzing the direction, dynamics, and magnitude of the stock’s price movement, VectorVest has provided an RT rating of 1.95, nearly tipping out the scale. But, the question is…will this trend hold, or is this just a fleeting moment? At the time of writing this, we’re already witnessing the stock starting its fall back to earth. Only time will tell - but with VectorVest, you can be the first to know…

All things considered, LLAP has earned an overall VST rating of 1.26 - which is very good. But is it enough to earn the stock a buy recommendation? Or, should you hold off a bit longer to see what happens as the hype around this deal fades out? Get a clear answer on your next move with a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, LLAP has very poor upside potential and poor safety. However, the stock does have excellent timing after securing this $2.4 billion deal.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment