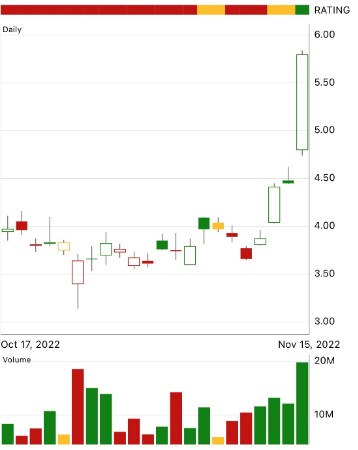

Chinese company Tencent Music Entertainment (TME) enjoyed a nice 26% jump during this morning’s trading session. As of about 12 PM EST, the stock sits at $5.66 – the highest it’s climbed since March of this year. This is the reversal investors have been waiting for, as the company sits about 35% lower than one year ago today.

But – what happened to send shares soaring? And, is there an opportunity for you to buy or sell the stock here?

What set this price trend in motion is the release of Tencent’s 3rd quarter earnings report. The music entertainment platform saw revenue growth year over year of 5.6% – or $1.04 billion. This figure missed analyst expectations of $1.23 billion.

There are a few reasons TME may have fallen short – but the overwhelming consensus is that the Chinese economy has slowed, just as the US economy has. Moreover, the company saw a decline in advertising revenue and lower gamer spending. The hope is that these trends will reverse as pandemic restrictions dwindle.

Nevertheless, the company saw an increase in profit of 38.7% year over year. This was a 22.5% increase from the 2nd quarter. This was the result of a focused attempt to cut operating costs within the company.

In looking ahead to the future, there is plenty to be excited about with Tencent’s strategy. The company has grown paid users to new heights and has diversified its music offerings to satisfy a broader range of customers.

Moreover, Tencent has partnered with top labels and artists worldwide on strategic collaborations – meaning more is to come in terms of diversifying music offerings. Executives mentioned that the plan is to double down on original content production capabilities, too. This will come in the form of an enhanced long-form audio (podcasts) platform – an increasingly lucrative segment within audio entertainment.

All things considered, there is no surprise shares of TME have surged over 25% today. But – looking beyond the initial hype around all this news, is there any reason for you to invest in the company? What sort of opportunity lies here? To give you a clear answer on what your next move – if any – should be with TME stock, keep reading. We’ll show you what we’ve found through the VectorVest stock analysis software.

Despite Poor Upside Potential & Safety, TME Displays Excellent Timing Right Now

VectorVest is a system based on objective stock analysis principles. It helps simplify investing for new and experienced traders alike by telling you everything you need to know about a stock based on three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting this rating is as straightforward as it gets. They sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate overperformance and vice versa. But the best part about using this system is that based on these ratings, VectorVest provides you with a clear buy, sell, or hold recommendation. Here’s what’s happening right now:

- Poor Upside Potential: The relative value rating assesses a company’s long-term price appreciation potential projected three years out, compared to AAA corporate bond rates and risk. And right now, the RV rating of 0.68 is poor. Moreover, TME is overvalued at the current price of $5.68 – the current value is just $3.82/share.

- Poor Safety: An indicator of risk, the RS rating analyzes the consistency and predictability of a company’s financial performance. It also takes into account the debt-to-equity ratio and business longevity. All this considered TME has a poor RS rating of 0.74.

- Excellent Timing: This is where things get interesting for investors – because TME has an excellent RT rating of 1.72. This is based on the direction, dynamics, and magnitude of the stock’s price trend. The rating is calculated day over day, week over week, quarter over quarter, and year over year.

In the end, the overall VST rating of 1.20 is good – but does that mean it’s time to buy? After all, the opportunity here is all based on timing – meaning you’ll need to know the perfect time to enter and exit your position to capture profits and minimize risk. For that, you’ll need the VectorVest system. Get a clear answer on your next move and execute it with confidence through a free stock analysis here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TME, it is overvalued with poor upside potential and safety – but it does have excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment