Starbucks (SBUX) investors have patiently awaited the overthrow of now-former CEO Howard Schultz – and it appears that the wait is over sooner than expected. New CEO Laxman Narasimhan took the throne approximately two weeks earlier than expected.

As a result, he’s going to make his first public address as the company’s leader in the upcoming shareholder meeting Thursday. All of this is coming after he spent the last few months preparing for the position – going to great lengths to learn the business, even undertaking barista training.

There are questions as to whether this move comes because Narasimhan is ready to take over sooner than projected – or because Schultz is ready to call it quits earlier than anticipated. He stepped in after the previous CEO Kevin Johnson dropped a bomb on everyone, announcing his retirement early.

In coming into this 3rd at-bat as Starbucks CEO, Schultz did away with the company’s buyback program, announced a new strategy that better aligns with the company’s business today, and fought barista union plans. As a result of this final point, Schultz is still set to appear in court on March 29 to defend against “union-busting” allegations.

Narasimhan has big shoes to fill, as he’s stepping in for a man who has brought the company’s market value to $113 billion – an 8% rise since taking over last April. This is especially impressive considering the S&P 500 as a whole has tanked over 13% in that timeframe.

Initially in Monday’s trading session, the market reacted positively to this news – sending shares 1.5% higher. But as of 12:30 EST, the spike has tapered off and appears to be heading back toward the price at which SBUX opened.

This probably leaves you with questions as to what you should do with this stock – if anything. Is this stock worth buying with the change in regime officially underway? Or, should you wait a bit longer to see what comes in the following days, weeks, or months?

We’ve got three things you need to see if you’re considering a Starbucks play. Get a clear recommendation on your next move through the VectorVest stock analyzer software below.

SBUX Has Poor Upside Potential, Good Safety, and Fair Timing

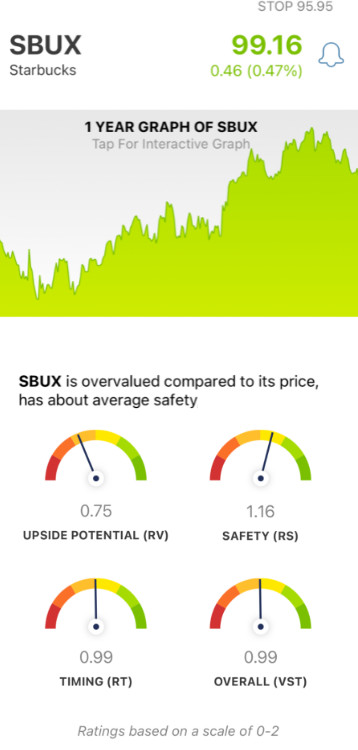

The VectorVest system helps you simplify your trading strategy by giving you all the insights you need in 3 easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average.

Based on these ratings, the VectorVest system is able to offer you a clear buy, sell, or hold recommendation for any given stock, at any given time - including SBUX right now! Here’s what you need to know:

- Poor Upside Potential: The RV rating assesses a company’s long-term price appreciation potential (three years out) compared to AAA corporate bond rates and risk. And right now, SBUX has a poor RV rating of 0.75. What’s more, the stock is overvalued with a current value of just $46.80.

- Good Safety: SBUX has a good RS rating of 1.16 - which is calculated based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: There isn’t a strong price trend right now for SBUX - and the fair RT rating of 0.99 reflects that, as it’s just below the average. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for SBUX works out to just 0.99 - which is fair, but below the average. So, should you buy SBUX as the Narasimhan era begins? Or, should you hold off and await a more meaningful price trend to form one way or the other before doing anything?

Don’t play the guessing game or let emotion influence your decision-making. Get a free stock analysis at VectorVest to feel confident about your next move!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SBUX, it is overvalued with poor upside potential - but it does have fair timing and good safety right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.