Shares of Splunk (SPLK) were trading higher in Wednesday afternoon’s extended trading session yesterday, and when the bell sounded this Thursday morning, they picked up where they left off. SPLK is up more than 13% so far after beating the consensus in the company’s second-quarter earnings.

The San Francisco software company grew revenue by 14% in the period to $910.6 million, up from just $798.7 million this time last year.

And, profitability is on the rise too. Last year, the company posted a net loss of $209.7 million, or $1.30 a share. This year, though, the company has improved to a net loss of $63.2 million, or 38 cents a share. On an adjusted basis, earnings came in at 71 cents per share, well north of the FactSet consensus of 46 cents per share.

Chief Executive Gary Steele released a statement attributing these results to an ongoing concentrated effort to harness the innovative power of AI. Throughout the quarter, the company shipped an array of advancements to help customers enhance their digital resilience and security.

Splunk executives also took the opportunity to share guidance for the current quarter, which again, came in above the analyst outlook. The company expects revenue to fall between $1.02 billion and $1.035 billion compared to FactSet analysts’ estimates of $982 million.

So far this year, SPLK has managed to outpace the S&P 500 index with 16% growth. With wind in the stock’s sails now, it could be poised to go on a run.

Earnings aside, we’ve taken a deeper look at the stock through the VectorVest stock forecasting software and uncovered 2 more reasons to consider investing in SPLK.

SPLK Has Excellent Upside Potential and Good Timing With Fair Safety to Boot

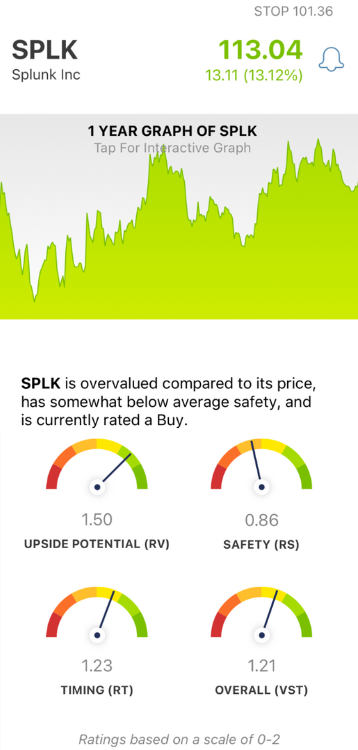

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average. But it gets even easier, as the system issues a clear buy, sell, or hold recommendation for any given stock, at any given time, based on these ratings. As for SPLK, here’s what we found:

- Excellent Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential and AAA corporate bond rates & risk. It offers far superior insights than a simple comparison of price to value alone. As for SPLK, the RV rating of 1.50 is considered excellent.

- Fair Safety: In terms of risk, SPLK is considered a fairly safe stock - although the RS rating of 0.86 is way below the average. This rating is calculated through an in-depth analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: As you can see in looking at how SPLK has trended over the past few days, it’s no surprise it has good timing - with an RT rating of 1.23. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.21 is good for SPLK, but is it enough to justify buying this stock? Or, should you wait to see if today’s trend holds before making your next move?

No need to play the guessing game or let emotion influence your decision-making. You can executive your next trade with complete confidence through a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SPLK is climbing higher after beating the analyst consensus for the quarter and doubling down on these results for the quarter ahead. The stock has excellent upside potential, fair safety, and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment