Southwest Airlines (LUV) is down more than 19% in the past week as it is feeling the effects of Boeing’s ongoing safety concerns after a panel blew out of a 737 MAX 9 jet earlier this year.

The airliner says that it will have to rethink its capacity for 2024 amidst the turmoil as it will accept fewer Boeing deliveries now. Thus, the company will be unlikely to deliver the revenue it originally forecasted.

This comes after the FAA uncovered a laundry list of issues during an inspection of Boeing’s 737 MAX production. The jet failed 33 of 89 audits. While Southwest was expecting to add 58 jets to its fleet this year, that number has been trimmed to just 46.

This news comes on the heels of Southwest’s Q4 earnings, which consisted of a 10.5% revenue growth to $6.8 billion. Much of this was attributed to 21.4% more seat miles available. An adjusted operating margin of 2.7% was a pleasant turnaround from the -5.6% margin the year prior.

However, the outlook for the current quarter is shaky now. On top of issues with Boeing deliveries, Southwest is also forecasting an increase in fuel prices. Costs per gallon could reach as high as $3 compared to the range of $2.70 to $2.80 previously.

The combination of rising costs and diminishing revenue spells disaster in the short term, but the consensus is that Southwest should recover in the long term.

Still, investors sold off their shares of LUV on this news, leading to the question: is it time to sell LUV yourself if you haven’t already? Or, should you take a speculative approach and buy this stock at a discount today?

We’ve taken a look at the situation through VectorVest’s stock analyzer and found 3 things that will help you make your next move with complete confidence and clarity.

LUV Has Poor Upside Potential, Safety, and Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It saves investors time and stress while empowering them to win more trades.

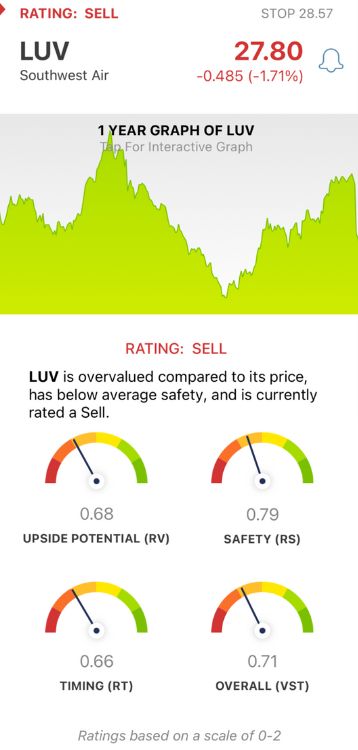

How does it work? Simple - you’re given all the insights you need in 3 intuitive ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even better though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for LUV, here’s what you need to see:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. LUV has a poor RV rating of 0.68.

- Poor Safety: The RS rating is a risk indicator. It’s calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. LUV has a poor RS rating of 0.79.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. LUV has a poor RT rating of 0.66.

The overall VST rating of 0.71 is poor for LUV, and the stock is currently rated a SELL in the VectorVest system.

Learn more about this situation or any other stock with a free stock analysis at VectorVest today. Eliminate stress, uncertainty, and guesswork from your decision-making process for good!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. LUV is down nearly 20% over the past week on concerns of how it will fare given the Boeing issues alongside rising costs. The stock has poor upside potential, safety, and timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment