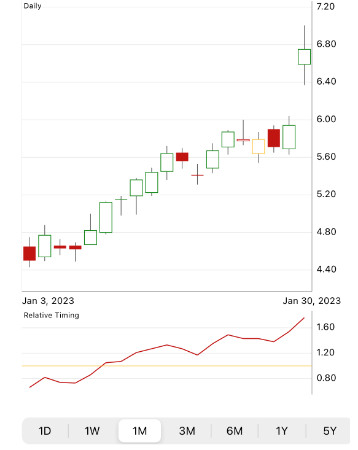

When we last wrote about SoFi, the stock was rated a sell with poor safety and timing. Insiders at the company were purchasing up shares despite what looked to be a tumultuous time at the company. But since then, SoFi has gained over 53% – and looks to have a solid trend with momentum behind it. How did we get here?

Today alone, the stock has risen 16%. This is the result of a 4th quarter earnings report where SoFi outperformed analyst expectations – while giving a favorable outlook for the year ahead.

While the company still saw a loss, it was dramatically lower than experts were anticipating. The company posted a fourth-quarter net loss of $40.0 million – which comes out to $0.05/share. This is a huge turnaround from the same period last year, which involved a much larger loss of $111 million, or $0.15/share. Analysts were expecting a loss of $0.09/share.

Net revenue for the quarter came in at $456.7 million, up substantially from last year’s $285.6 million in the same period. This figure also exceeded the analyst’s anticipated $423 million net revenue.

Looking ahead to the future, SoFi expects a solid 2023 – where they hope to report a positive GAAP net income in the fourth quarter of 2023. For the full year, they’re expecting $260 million to $280 million in adjusted EBITDA.

This news has investors excited about SoFi, buying in now at what could be a great value this time next year. Should you do the same? Or, should you wait to see how the first quarter goes for SoFi? You don’t want to miss out on an opportunity to get into this stock early – so keep reading to discover a clear answer on your next move through the VectorVest stock analyzer software.

Despite Poor Upside Potential and Safety, SOFI Has Excellent Timing

The VectorVest system simplifies trading by telling you everything you need to know about a stock in three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these ratings sits on the same simple scale of 0.00-2.00 – with 1.00 being the average.

The best part is that based on these ratings, every stock is given an overall VST rating – along with a clear buy, sell, or hold recommendation. As for SOFI, here’s what you need to know before making your next move:

- Poor Upside Potential: The long-term price appreciation potential – compared to AAA bond rates and risk – is poor for SOFI with an RV rating of 0.82. The stock is also overvalued at its current price, with a current value of just $4.84.

- Poor Safety: In terms of risk, SOFI still exhibits poor safety – as seen through a poor RS rating of 0.59. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: Where things get interesting for SOFI is the excellent timing it has right now – which is confirmed by the RT rating of 1.80. This is derived by analyzing the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year – so you always have the full picture at your fingertips.

The overall VST rating for SOFI is 1.25 – which is very good. But does that mean you should buy SOFI purely based on timing – or should you wait for the upside potential and safety to turn around? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis here at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, SOFI is overvalued with poor upside potential and safety – but the stock has excellent timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment