Shopify Inc. (SHOP) shared fourth-quarter earnings that exceeded analyst expectations, and yet, the stock is down more than 10% so far in Tuesday morning’s trading session. It’s the outlook for expenses that has investors and analysts concerned.

The e-commerce platform provider posted a net income of $657 million for Q4, a dramatic turnaround from this time last year when we witnessed a net loss of $623 million. The adjusted earnings of 34 cents per share beat out the 30 cents analysts were forecasting.

Revenue climbed for the quarter too, up to $2.1 billion from $1.7 billion this time last year. The revenue was right in line with the FactSet consensus. Growth is accelerating in the gross merchandise volume category, though, up 23% to $75.1 billion.

CFO Jeff Hoffmesiter says that the company expects to keep its foot on the gas for 2024, with the goal of delivering top-line growth and profitability. Revenue growth of at least 20% is the goal, whereas analysts are forecasting 19% growth.

However, it appears as if the disclosure of expense growth stole the spotlight from all the positive takeaways. Shopify is expecting operating expenses to climb as much as double-digit percentage points.

Experts question not just rising margins, but the high valuation SHOP sits at relative to those increases. The expectation is that this news will place pressure on the stock as buy-side expectations are higher than ever.

The stock had rallied 15% leading into this news but has since retreated. Still, SHOP is up 4% through the first month and a half of 2024. So, where does that leave investors or potential traders?

We’ve taken a look at this opportunity through the VectorVest stock forecasting software and found 3 things that will help you make your next move with confidence and clarity.

SHOP Still Has Very Good Upside Potential and Excellent Safety, But Fair Timing Holding it Back

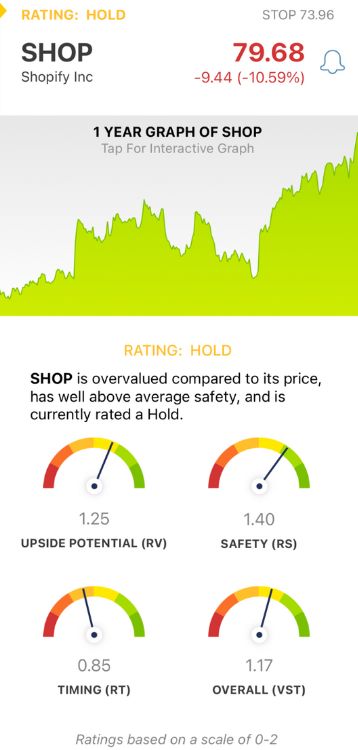

VectorVest is a proprietary stock rating system that simplifies your trading strategy. You’re given all the insights you need to make clear, calculated decisions in 3 ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even easier, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for SHOP, here’s what you need to know:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. As for SHOP, the RV rating of 1.25 is very good.

- Excellent Safety: The RS rating is a risk indicator derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. SHOP has an excellent RS rating of 1.40.

- Fair Timing: The one thing holding SHOP back is the fair RT rating of 0.85, which is a ways below the average and reflects the steep dropoff today. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.17 is good for SHOP, but it’s currently rated a HOLD in the VectorVest system. We encourage you to learn more about this situation and stay up to date with a free stock analysis!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SHOP delivered a solid Q4 performance to end the year, accelerating growth and beating profit estimates handily. Yet, the concern of growing expenses forecasted in the upcoming quarter stole the spotlight, sending shares retreating. The timing may be just fair for this stock, but it still has very good upside potential and excellent safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment