Scholastic Corp. (SCHL) announced early today that they will be initiating a stock buyback worth up to $75 million – approved by their board of directors. The common stock repurchase will take place through a Dutch Auction and is expected to fall somewhere in the purchase price/share of $35-40 – not accounting for taxes/interest.

Anytime a stock repurchase is initiated investors perk up. Your ownership value rises dramatically through the diminishment of outstanding shares. And the company benefits from investing directly in themselves too.

Scholastic CEO Peter Warwick said that while the entity’s priority remains on investing in strategic growth opportunities (organic & inorganic) & maintaining a strong balance sheet, they are also focused on taking care of their shareholders. And that’s exactly what this play will do – as excess capital is put into the pockets of shareholders.

However, Warwick also spoke to the fact that the current share price was a considering factor in this stock buyback initiation. He says that compared to the current value of Scholastic stock, today’s price is an incredible value.

So far, it appears the move is working exactly as Scholastic had hoped for, as shares have shot up over 13% and counting so far this morning. And it came at the right time – as the company took a big dip in the last 3 months. Towards the end of September, SCHL stock dropped over 30%. They had a poor start to the year, reporting an 82% decline in fiscal first-quarter operating income – and 74% lower earnings before taxes.

However, the stock rallied back after hitting a low point for the year of $29.08/share on September 28. After the release of Scholastic’s stock buyback news, shares are up almost 15% in the last 7 days. This increase has helped them recover in the big picture – they’re now showing positive growth over the past 365 days, up 6% – while most of the market is still in recovery.

So – in considering all this, what should your next move be as an investor? Is this a good time to buy SCHL stock? OR, should you continue waiting to see what happens in the coming weeks? The VectorVest stock forecasting tools can give you a clear answer on what your next move should be – keep reading to get a clear buy, sell, or hold recommendation for this stock right now.

3 Key Ratings Tell You Everything You Need to Know About SCHL Stock

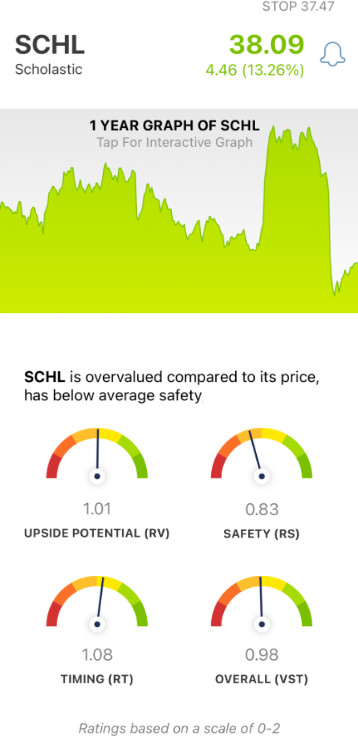

VectorVest simplifies trading by telling you everything you need to know about a stock in just three key ratings. They are relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 to allow for effortless interpretation – the higher the ratings sit on this scale, the better.

And, based on the overall VST rating for a company, the system provides you with a clear buy, sell, or hold recommendation – making trading easier and less stressful than ever before. As for SCHL, here is the current situation…

- Fair Upside Potential: Taking a look at the long-term price appreciation potential for SCHL, VectorVest provides an RV rating of 1.01. This is fair on a scale of 0.00-2.00 – right around the average. However, it is worth noting that VectorVest deems the stock to be overvalued at the current share price of $38.09 – with a current value of $30.56.

- Poor Safety: The RS rating is an indicator of risk – it looks at the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for SCHL, the RS rating of 0.83 is poor.

- Fair Timing: When evaluating SCHL’s price trend, you can see that there is an obvious spike as a result of today’s news. But, the RT rating takes a deeper look at price movement – evaluating the direction, dynamics, and magnitude of the trend in the short, medium, and long term. As for SCHL, the RT rating of 1.08 is just fair.

Now, with all this said, the overall VST rating for SCHL is fair at 0.98. So – what should your next move be as a trader? To eliminate any guesswork or emotion from your decision-making, get a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SCHL, it is overvalued with fair upside potential and timing, but it has poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment