Plug Power Inc. (PLUG) is down more than 8% so far in Thursday’s trading session after the stock received a downgrade from a team of analysts at SIG Susquehanna. As economic challenges continue to mount, the company has been changed from positive to neutral.

Biju Perincheril and a team of other analysts pointed to the expectation that headwinds will continue to push against the residential alternative energy segment through at least the first two quarters of 2024.

The analysts referenced their conversations with other companies that suggested a continued slow recovery for demand in this market as a result of NEM (net energy metering) changes in California coupled with overall weak demand in the south.

The SEIA (Solar Energy Industries Association) even updated its own forecast from a 7% decline to now a 12% decline in US residential installations. This can be attributed to a combination of sky-high interest rates, falling utility rates, and NEM changes.

That being said, it’s not all negative for Plug Power. SIG Susquehanna sees improvement on the horizon in the second half of the year as interest rates come back down to earth. The company will also benefit from falling equipment prices, utility rate hikes, and other tailwinds. These will provide a lift at the end of 2024 and through 2025.

In the meantime, though, things do look bleak for PLUG – as the stock has now fallen 50% in the past 3 months and 75% in the last year.

This comes after the company themselves warned investors of a going concern for the future. Quarterly losses continue to mount amidst a severe hydrogen shortage, and Plug Power has a deep hole to climb out of with a $3.8 billion deficit as of Sept. 30.

That being said, should you cut losses on PLUG? We’ve got your answer after taking a look through the VectorVest stock forecasting software. Here’s what you need to know…

PLUG Has Fair Upside Potential, But Poor Safety and Very Poor Timing Dragging it Down

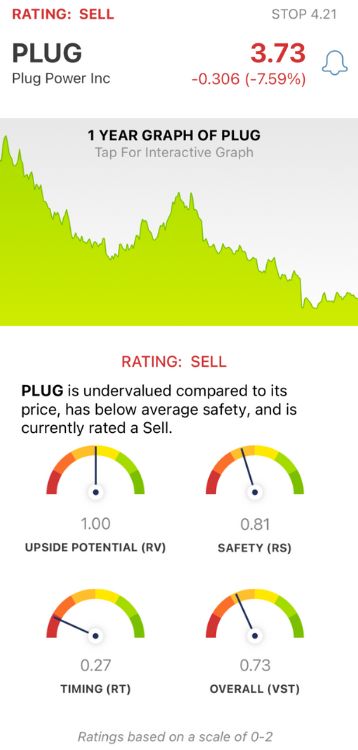

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - simplifying your strategy and empowering you to win more trades with less work. It’s based on 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. It gets even better, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on the overall VST rating. As for PLUG, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insight than a simple comparison of price to value alone. The RV rating of 1.00 is right at the average for PLUG. The stock is undervalued with a current of $5.02.

- Poor Safety: The RS rating is a risk indicator calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other risk factors. PLUG has a poor RS rating of 0.81.

- Very Poor Timing: The biggest issue for PLUG is the strong negative price trend that’s pushed its price lower and lower over the past year. The stock has a very poor RT rating of 0.27. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.73 is poor for PLUG, and the stock is currently rated a SELL in the VectorVest system. Learn more about this situation or any other opportunity through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLUG is down more than 8% after being downgraded from “positive” to “neutral”. The company is facing serious economic headwinds for the near term and has a huge hole to climb out of. The stock may have fair upside potential, but its safety is poor and its timing is very poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment