Yesterday in Thursday’s trading session, Peloton (PTON) announced a new partnership with TikTok, sending shares 9% higher. The stock picked right back up in Friday morning’s trading session and has climbed more than 15% so far.

Peloton will get its own “Hub” on TikTok, and it will be referred to as “#TikTokFitness Powered by Peloton”. Here, Peloton will be able to create and distribute custom content such as live classes, original instructor series, collaborations with other creators, and more.

There’s a lot of buzz around this deal as it represents the exercise equipment company’s first time ever producing content for anything but its own channels. It’s a creative way to bring more people into the Peloton ecosystem and grow the brand in an organic way.

Considering the infamous Chinese social media platform garners more than a billion users around the world, it’s clear to see what has Peloton and its investors excited about this partnership.

This collaboration comes after Peloton partnered with Lululemon last fall, in which Peloton became the exclusive provider of digital fitness content to members of Lululemon’s app and membership program.

The company is branching out and finding new ways to engage existing customers and potential customers, but internally it has been nothing short of tumultuous. Peloton’s subscriber base has been steadily shrinking while the company takes on bigger and bigger losses.

That being said, the stock is now up 19% this week – a great start to 2024. Is all this enough to justify buying PTON, though? Not quite. We’ve taken a look through the VectorVest stock analysis software and found 3 things you need to see.

PTON May Have Excellent Timing, But it Also Has Poor Safety and Very Poor Upside Potential

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - empowering you to win more trades with less work and stress.

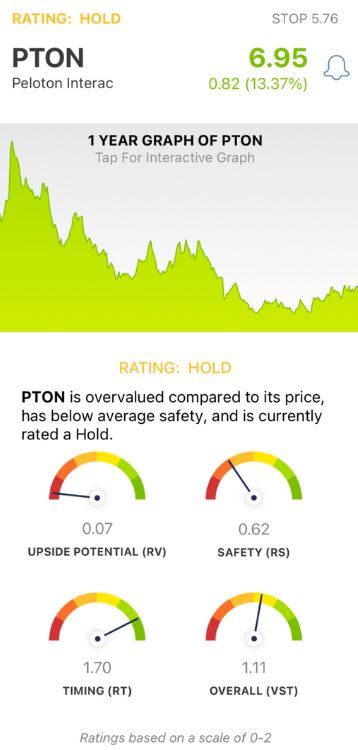

You’re given all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

But, it gets better. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for PTON, here’s what we’ve found:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. As for PTON, the RV rating of 0.07 is very poor.

- Poor Safety: Moreover, the stock has a poor RS rating of 0.62. This risk indicator is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors.

- Excellent Timing: The one thing PTON has going for it is the strong, positive price trend that’s formed in the past few days. The stock has an excellent RT rating of 1.70, which is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.11 is good, but it’s not enough to earn the stock a buy. It is currently rated a HOLD in the VectorVest system. You can learn more about how VectorVest works or the current opportunity with PTON through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PTON is up nearly 20% over the past few days after announcing its partnership with TikTok. The stock has excellent timing - but it’s being held back by poor safety and very poor upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.