The trend toward electric vehicles has paved the way for new companies like Tesla while existing automakers such as Ford, Mercedes, Honda, BMW, and others have all pivoted their manufacturing processes as well to focus on EVs.

However, not enough emphasis is placed on the smaller EV makers like Li Auto (LI) – a Chinese automaker that many experts are keen on right now. In fact, some journalists have referred to the company as “the only auto stock you should own” – a bold claim to say the least.

The company utilizes a “battery first” technology in its hybrid cars, namely the new Li 9. This full-size automobile seats 6, has self-driving automation, and most importantly, has a range of 682 miles between fill-ups. At just $64,000, it’s punching way above its weight class in terms of value.

Li Auto has been fighting a price war against Tesla, and surprisingly, is holding its own. The company performed well in 2023, delivering $17.2 billion in revenue and $1.54 per share. An operating margin of 6% led to $6.14 billion in free cash flow, so the company will only continue to get better with ample means for reinvestment.

However, the first all-electric vehicle by Li just hit the market last week: the Mega. This minivan boasts a range of 310 miles with a 10-minute charging capability. The company has invested in its own network of 10,000 superchargers to support the launch of this EV. This network will be live by 2025.

Looking ahead to the current year, Li expects to double its production to a whopping 800,000 cars. The company is competing in the same market as Tesla, a much larger name here in the US.

Although the stock surged 36% over the past month, it’s down more than 12% today to start the week. This begs the question – should you really bet on a smaller company that’s fighting against a giant led by Elon Musk?

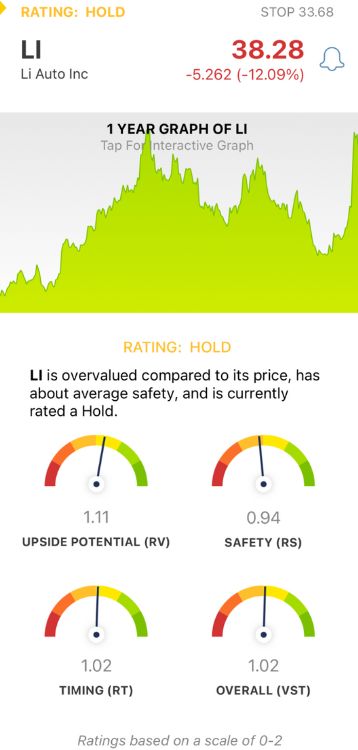

Purely from a stock analysis standpoint, we’ve taken a look at LI in the VectorVest stocks software and found 3 things investors need to see.

LI Has Good Upside Potential With Fair Safety and Timing

VectorVest is a proprietary stock rating system that saves you time and stress while empowering you to win more trades. You’re given clear, actionable insights in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even better. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for LI:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. LI has a good RV rating of 1.11 right now.

- Fair Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. LI has a fair RS rating of 0.94.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. LI has a fair RT rating of 1.02.

The overall VST rating of 1.02 is fair for LI, but it results in a HOLD recommendation for the time being. You’re going to want to stay up to date on this opportunity and wait for the right time to buy this stock.

So, get a free stock analysis today and learn more about how VectorVest can transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. LI is leading the charge in the Chinese EV market, and some professionals believe it has the ability to fight with TSLA. While the stock has good upside potential along with fair safety and timing, it’s still rated a HOLD.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment