Gap Inc. (GPS) delivered an impressive Q1 performance, beating the analyst consensus on both the top and bottom lines. The stock has climbed 26% so far in Friday’s trading session in response.

Sales grew 3% to $3.4 billion in the first quarter, driven in part by stronger sales in the Old Navy brand. Analysts were expecting $3.29 billion in sales.

Meanwhile, the company’s earnings came in at $158 million which worked out to 41 cents a share. This was a massive turnaround from the same quarter last year in which Gap posted a loss of $18 million, or 5 cents a share. Experts were anticipating 15 cents per share.

CEO Richard Dickson says that the company’s first-quarter results are a result of stronger sales trends, margin improvements, tighter cost control, a better inventory position, and an optimized balance sheet. Dickson went on to say that with a strong financial footing, Gap is well positioned to continue delivering in the road ahead.

On that note, the company is now forecasting a stronger full-year net sales performance. The previous outlook was for sales to remain flat year over year, but now, net sales should be slightly up. In the near term, Gap is expecting fiscal Q2 growth in the low single digits.

There’s been a lot of exciting happenings for the company over the past few months, and this first-quarter performance is a cherry on top. Just a few weeks back Gap’s dresses were worn on the red carpet by the likes of Anne Hathaway and Da’Vine Joy Randolph. The company also recently brought in Zac Posen as the new creative director.

GPS has been on a tear recently, up 47% in the past 3 months now. It’s up 37% through 2024. That being said, is this earnings beat and guidance update enough to justify buying this stock? We’ve taken a deeper look at this opportunity through the VectorVest stock analysis software and found 3 reasons to consider buying GPS.

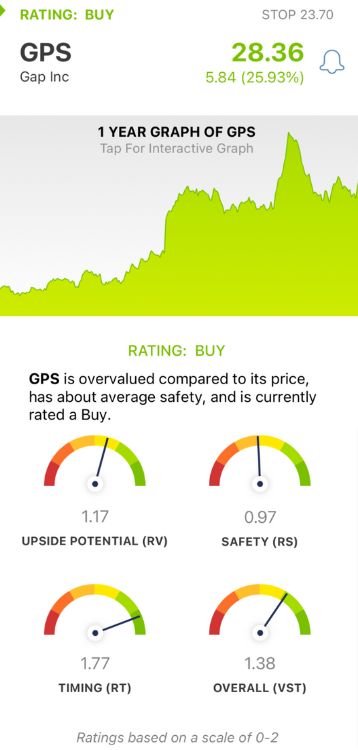

GPS Has Good Upside Potential, Fair Safety, and Excellent Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It’s done this while simplifying analysis, boiling down complex technical indicators into just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy. It gets even better though. The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for GPS:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. GPS has a good RV rating of 1.17.

- Fair Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.97 for GPS is just below the average but deemed fair nonetheless.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. GPS has an excellent RT rating of 1.77, reflecting its strong performance so far this year.

The overall VST rating of 1.38 is very good for GPS, and enough to earn this stock a BUY recommendation. But before you make that next move, take a brief moment to assess this free stock analysis - trust us, you’re not going to want to miss out on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. GPS delivered an impressive Q1 performance on both the top and bottom lines. The company also lifted its guidance for the full year, sending the stock soaring 26% Friday. It has good upside potential, fair safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment