While many stocks are moving downwards this morning, one stock has made a nice 5% jump since the market opened – and that’s Crispr.

The company is engaged in the development of transformative drugs based on gene therapy. And news just released that they are finally on the path to seeking FDA approval for their new drug. But – does this mean now is the time to buy? We’ll take a look at what this news means for the company, and more specifically, what it means for investors.

Crispr drugs are based on a revolutionary CRISPR technology – where the company’s name comes from. This tech allows for precise, direct changes to the genomic DNA that causes various ailments for some patients. Currently, the firm offers a suite of different therapeutic programs, spanning a wide array of disease areas. These include hemoglobinopathies, oncology, regenerative medicine, and rare diseases.

The specific disease that this new drug is targeting is Sickle Cell Disease. And while they haven’t actually begun the process with the FDA quite yet, they aim to submit their application by November. The plan is to have all necessary documentation submitted by the first quarter. So – it may be a bit early for investors to be getting excited.

Moreover, the FDA will inevitably want more long-term data on the drug before granting approval. And at this time, Crispr simply doesn’t have that data. Nevertheless, the stock is already moving upwards. And this modest jump alone is a welcome sight for investors who currently have positions in CRSP stock, which is down 44% this year.

In saying all this, does this low point where the company’s stock sits right now present a good opportunity to buy at a great value? Or, should you await further validation that this drug is “the real deal” before tying up your capital in a stock that doesn’t move for another 6+ months? We can help you tune out the noise you’re seeing in the headlines and just get down to tried-and-true stock analysis fundamentals.

The VectorVest stock forecasting software allows you to gain a clear buy, sell, or hold recommendation for any given stock, at any given time. Keep reading to see what it has to say about CRSP.

Despite Preliminary News on CRSP’s New Drug, the Stock’s Upside Potential, Safety, & Timing are Poor

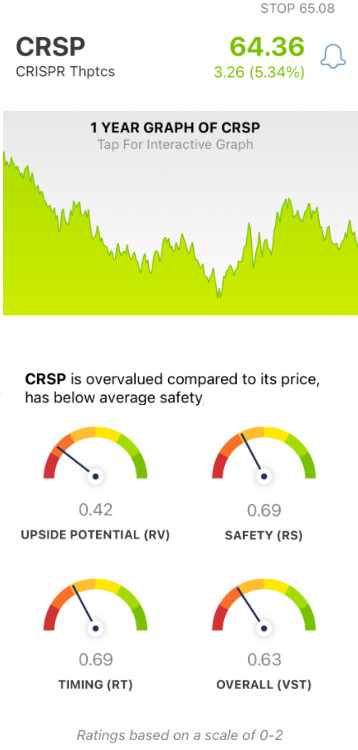

VectorVest relies on just three simple metrics to paint the entire picture of a stock: relative value (RV), relative safety (RS), and relative timing (RT). These are placed on an easy-to-understand scale of 0.00-2.00 – the closer to 2, the better. And together, these figures make up the overall VST rating a stock is given – and dictate what VectorVest recommends you do. And for CRSP stock, here’s the current situation…

- Very Poor Upside Potential: the RV rating looks at a stock’s long-term price appreciation potential – up to three years out. The current RV rating for CRSP is just 0.42 – very poor on a scale of 0.00-2.00. Moreover, the stock is overvalued at the current price of $64 – VectorVest calculates its current value to be just $23.

- Poor Safety: an indicator of risk, the RS rating is computed from an analysis of a company’s financial predictability/consistency, business longevity, debt-to-equity ratio, and other risk factors. As for CRSP, the RS rating of 0.69 is poor – suggesting high risk.

- Poor Timing: finally, the RT rating looks at a stock’s price trend – in the short, medium, and long term. It factors in the direction, dynamics, and magnitude of the price trend a stock has. And as you can see by looking at a graph of CRSP stock, the negative price trend has manifested itself in a poor RT rating of 0.69 – suggesting the price could continue to fall.

As you can imagine, the overall VST rating for CRSP is poor at 0.63. Does this mean you should sell any outstanding shares of CRSP you have in your portfolio? Or is this still a good opportunity to buy at a low price? To get a clear answer on your next steps, analyze stock free here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for CRSP, it is overvalued with very poor upside potential in spite of the news regarding their new drug. Furthermore, the stock has poor safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment