Anheuser-Busch – the parent company for Bud Light – has made nationwide waves with its latest promotional marketing tactic. After partnering with transgender influencer Dylan Mulvaney, the company has received a barrage of criticism.

While BUD stock is down in the past week, the company’s competitors are thriving – one of which is Molson Coors Beverage (TAP). With more than a 6% rally in the last week, Coors has certainly benefited from Anheuser-Busch’s decision to go with a hot-button promotional strategy.

This is the result of individuals who oppose this promotional strategy putting their money with their mouths are – like GOP congresswoman Marjorie Taylor Greene. She took to social media to express her distaste over this move, saying she’s now switched to Coors. Other celebrities that have been vocal about their displeasure with Anheuser-Busch include Kid Rock and Travis Tritt.

It’s fair to say that the price trend we’ve witnessed today is based purely on market noise. One expert chimed in on this topic saying that it’ll be hard to make money in a situation like this as everyone’s already made their move with Coors after the Dylan Mulvaney news.

However, in looking at Coors from purely a stock analysis standpoint, the company recently enjoyed a nice earnings beat for the 4th quarter of 2022. While sales fell short of estimates, EPS jumped dramatically – up 61% year over year.

In saying that, is there any reason to add Coors to your portfolio – or should you simply tune out the noise and find another opportunity elsewhere? We’ve got 3 things you need to see through the VectorVest stock analyzing software to help you make your decision.

Despite Good Timing, TAP Still Has Poor Upside Potential & Safety

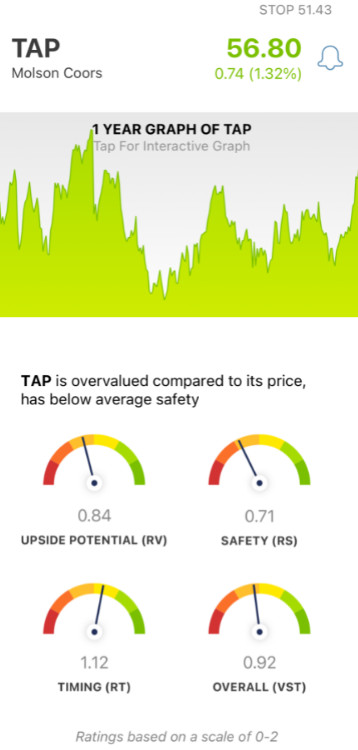

The VectorVest system helps you uncover winning opportunities on autopilot through a proprietary stock-rating system. You’re given all the insights you need in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average. And based on a stock’s overall VST rating, the system provides you with a clear buy, sell, or hold recommendation. As for TAP, here’s what you need to know:

- Poor Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. And right now, the RV rating of 0.84 is considered poor for TAP. And after the recent surge in price, the stock is now considered overvalued - with a current value of just $50.81.

- Poor Safety: An indicator of risk, the RS rating is poor for TAP at just 0.71. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: The one thing TAP has going for it right now is good timing. The stock was already climbing prior to the Bud Light debacle, and now the price trend has been strengthened. As a result, the RT rating of 1.12 is good. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

In averaging these out, the overall VST rating for TAP is just 0.92 - which is below the average, but fair nonetheless. So, does that mean this stock is worth adding to your portfolio? Or, should you tune out the noise and find a better opportunity to allocate your capital? Get a clear buy, sell, or hold recommendation through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TAP, it has good timing after the Anheuser Busch advertising mishap sent shares higher - but the upside potential and safety for this stock are poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment