Chipotle Mexican Grill (CMG) climbed 6% higher Wednesday morning after announcing that its board of directors had approved a 50 to 1 stock split. This will make the stock more accessible to employees along with other retail investors, as it currently trades at around $2,973/share.

If the company gains shareholder approval for the move in the upcoming June 6 meeting, it will represent the first stock split in the food chain’s history, spanning more than 30 years. Every shareholder will receive 49 more shares for each 1 they own. This would take place on June 25th after the market closes.

That’s not all, though. Chipotle also announced a plan to support its GMs and long-tenured employees who have been around for more than 20 years with a special one-time equity grant.

This unique incentivized stock compensation is the company’s way of saying thank you to the people responsible for driving its business to record highs on both the top and bottom line – as well as in terms of the stock itself. CMG has climbed more than 75% in the past year.

The news comes after an impressive fourth quarter in which the Mexican food chain posted revenue growth of 15.4% and adjusted profit growth of 25% year over year. Looking ahead to the current year, Chipotle is forecasting mid-single-digit growth across same-store sales.

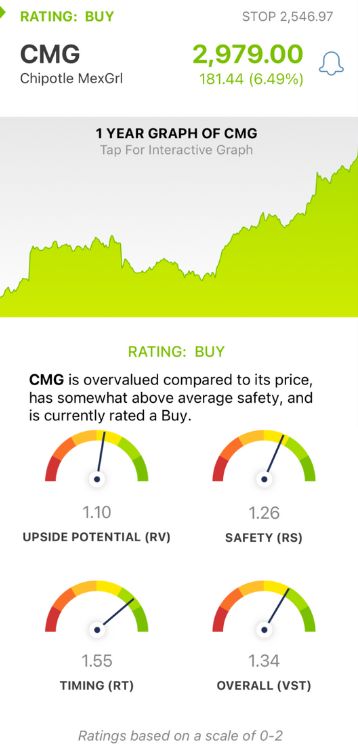

CMG is on pace for its highest trading price in history today, and the belief is that this stock will continue its momentum – pushing higher highs and higher lows. So, is now a good time to buy this stock? We’ve taken a look through the VectorVest stock analysis software and found 3 more compelling reasons to buy CMG today.

CMG Has Good Upside Potential, Very Good Safety, and Excellent Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It’s done this while saving investors time and stress, giving you clear, actionable insights in just 3 simple ratings.

These ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy.

It gets even better, though. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for CMG:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This offers much better insight than a standard comparison of price to value alone. As for CMG, the RV rating of 1.10 is good.

- Very Good Safety: The RS rating is a risk indicator that’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. CMG has a very good RS rating of 1.26.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. The excellent RT rating of 1.55 reflects the performance CMG has put on over the past year or so.

The overall VST rating of 1.34 is very good for CMG, and enough to earn the stock a BUY recommendation. But before you make your move, we encourage you to learn more about this opportunity with a free stock analysis at VectorVest. You don’t want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CMG has approved a 50 for 1 stock split, marking the first split in the company’s history. This comes after the company has delivered record revenue, profits, and stock growth. As for the stock itself, it has good upside potential, very good safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment