Carvana (CVNA) jumped 38% Friday morning after the online car retailer delivered a pleasant surprise in its Q4 earnings. While the company is still losing money, it’s slowly but surely becoming more profitable – and there’s reason to be optimistic about the road ahead.

The company reported revenue of $2.4 billion, falling just shy of analysts expectations of $2.56 billion. This was a 15% step backward year over year, as Carvana reported $2.8 billion this time last year.

However, profitability is improving. The company reported a massive $806 million loss in Q4 last year. But for the most recent quarter, Carvana posted a loss of $144 million, which comes out to $1/share. This was still a disappointment to analysts who were expecting a loss of just 85 cents per share, though.

The automotive retailer sees strength so far through the first quarter and believes it will post an adjusted EBITDA well above $100 million. While the macroeconomic and used car industry specifically still appears uncertain, Carvana is forecasting a solid uptick in sales.

While the stock still has a long way to go to recover its 2021 high of $360 per share, CVNA has certainly turned things around since bordering on bankruptcy just over a year ago. It dropped to a low of right around $4 per share until restructuring its debt with bondholders.

These efforts to improve liquidity have paid off, as CVNA has surged 589% in the past year. So far through 2024, the stock has gained 38%, greatly outpacing the S&P 500 index.

That being said, is it time to consider investing in CVNA once again? Not quite. We’ve taken a look through the VectorVest stock analysis software and still see a few things holding this stock back. Here’s what you need to know…

CVNA Still Has Very Poor Upside Potential, But Fair Safety With Excellent Timing is Promising

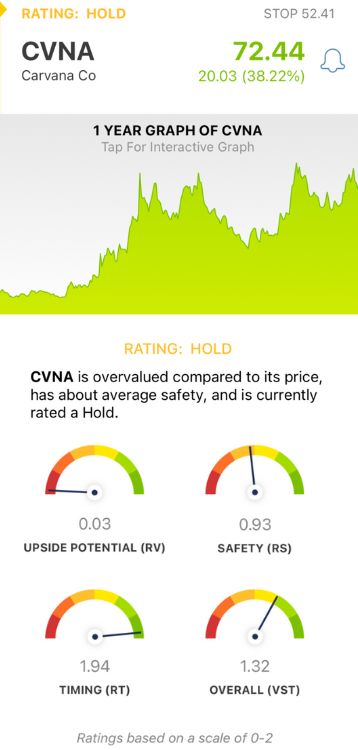

VectorVest empowers you to win more trades with less work and stress, giving you all the insights you need to make clear, calculated decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even better. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for CVNA, here’s what we’ve found:

- Very Poor Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (based on a 3-year price projection) to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. As for CVNA, the RV rating is about as poor as it gets at 0.03.

- Fair Safety: The RS rating is a risk indicator. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. CVNA is a fairly safe stock with an RS rating just below the average at 0.93.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As you can see from CVNA’s performance in both the short and long term, it has excellent timing - with an RT rating of 1.94.

The overall VST rating of 1.32 is very good for CVNA, but it’s still not enough to earn the stock a buy. It’s currently rated a HOLD.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CVNA climbed 38% Friday after posting a much narrower loss than last year, while also sparking optimism about the road ahead. While the stock still has very poor upside potential, it has fair safety with excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment