Roku recently shared its fourth-quarter results, and analysts received the news differently. Some believe the company is a long-term winner, while others see potential problems in its business. Although Roku shares had increased 69% at the beginning of 2023, its value over the past twelve months is down nearly 50%. Let’s explain what’s happening at Roku, explain why the analyst outlook is mixed, and discuss how VectorVest analyzes the stock.

On Feb 15th, Roku reported its fourth-quarter earnings, showing operating losses of $249.9 million and net revenue of $867.1 million. Analysts expected revenue performance of $803 million for the quarter, which was welcome news to investors. The company also outlined a plan to cut expenses and generate positive adjusted earnings in 2024, which could help drive up Roku’s share price.

Despite significant losses, not all was bad news for the company. Streaming hours increased by 23 percent year-over-year, and the ad platform side of Roku drove most of its revenues, while television and streaming device sales slumped 18 percent. Although Roku still estimates net losses into the first quarter of 2023, some analysts believe that investors are underestimating Roku’s long-term potential and have started upgrading their stock outlook.

Roku estimates net losses of $205 million in the first quarter of this year, with net revenues of $700 million and gross profit of $310 million. Executives have a positive outlook in the future, believing they’ll achieve profitability for the first time in 2024, after updating their products and improving their ad revenue business. Roku is in more homes throughout the world than ever before, but whether that’ll lead to long-term success depends on the industry as a whole. As a response, analysts have mixed feelings.

BofA Securities recently announced a double upgrade of the stock, believing that Roku is set to outperform the ad industry, which investors believe is showing weaker performance than in previous years. BofA Securities’ Ruplu Bhattacharya moved Roku from underperforming to buy, believing that ad spending is bottoming out in popular advertising categories, which he believes Wall Street as a whole is underestimating. His price objective is $85.

Despite this recent stock upgrade, other analysts don’t agree with BofA Securities’ outlook. For instance, Wells Fargo’s Steven Cahall believes that Roku can target $67 a share, although he believes the ad market will worsen before it gets better. This is because, unlike other streaming platforms, Roku doesn’t earn much from political or sports advertising as its major competitors do.

On the other hand, Investment bank Evercore’s analysts believe that Roku holds back ad slots during advertising sales and that the company could benefit from this after the challenge is resolved. With a target of $80 per share, Evercore’s analysts believe the company’s future performance could be boosted by their CEO hiring spree in the fall of ’22, including former Fox Entertainment CEO and two other executives.

But not everyone is so optimistic about Roku’s outlook. Analysts at MoffettNathanson, with a target price of $38, think that competitors’ strengths have propped up Roku’s price. They are worried that networks such as Disney, which pay for ads on the platform, will cut spending and reduce Roku’s ad revenue in the future.

The analysts also aren't sure whether manufacturing their smart devices will be a benefit or if it will cut into profit margins when the company could have used partnerships to achieve the same result. With these mixed results among Wall Street analysts, let's turn to VectorVest analysis to clarify the overall strength of ROKU.

Buy, Hold, or Sell? Here's How to Think About Roku Given Its Mixed Analyst Outlook

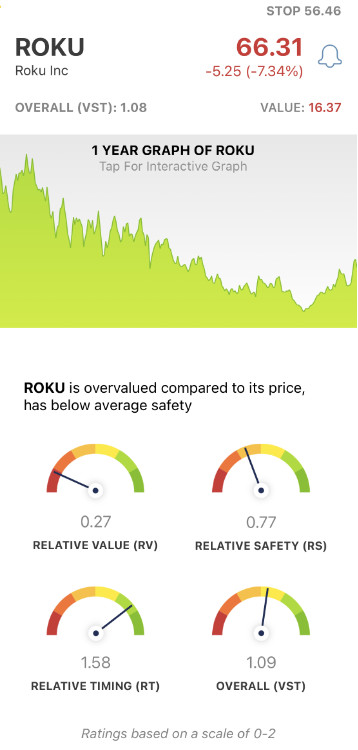

The VectorVest system changes the way you trade for the better. It tells you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Gaining insights from these ratings is fast and straightforward, as they sit on a simple scale of 0.00-2.00. Pick stocks with ratings above the average of 1.00 and win more trades!

Making things even easier, the VectorVest system provides you with a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotion clouding your judgment. As for ROKU, here’s the current situation:

- Very Poor Upside Potential: According to VectorVest, analysts with a more pessimistic outlook on Roku are likely correct. ROKU's RV is 0.27, indicating the company has very poor upside potential over the next three years. Additionally, VectorVest forecasts a current value of $16.37 a share, well below the current price of $65.90.

- Poor Safety: With a Relative Safety score of 0.77 on a scale from 0.00 to 2.00, ROKU is rated as a poor stock to own from a safety perspective. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one positive about Roku, according to VectorVest analysis, is its timing. The stock’s RT score of 1.58 indicates enough positive momentum to rise in the short term. This rating is calculated based on the trend’s direction, dynamics, and magnitude. It’s analyzed day over day, week over week, quarter over quarter, and year over year so you have the full viewpoint.

These three factors combined give Roku an overall Value-Safety-Timing rating of fair, with a score of 1.09 on a scale from 0.00 to 2.00. Does it earn ROKU a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ROKU, it is overvalued with very poor upside potential, poor safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment