How to Be Imperfect with Money

During the latest episode of Fantastic Female Fridays, I interviewed Allegra Brantly, Factora Wealth on the topic of “How to be Imperfect with Money”. We chose that title because often the thought “I must be fully ready/prepared/educated to take action” can truly debilitate people from moving forward. If you’ve ever read any personal development books or listened to speakers in this area, they will always point out the impact of taking small, consistent steps towards your goals. We wanted to spell this out in very specific terms for anybody nervously biting their lip as they mull over what’s stopping them from moving forward whether that is getting started with investing in any way, moving from paper trading to real money, or taking more ownership of what happens with your finances.

Here are four of Allegra’s key points:

🙋♀️ Earning more is not the same as having more

Many people think that earning more money is the cure for all their financial ills. If I earn more, then I would have money to set aside for investing or donating towards that specific cause or setting up a side hustle, etc. However, due to the proportional increase in your taxes, more discretionary spending, and less caution towards your outgoings, one might be shocked at how little their balance at the end of the month or year might be even after a pay rise. The key way to lock in the difference so that there is a tangible, noticeable change is to set up automation. Put a process in place where x amount of dollars, euros, sterling, etc goes into a particular account for a specific purpose so that you can feel the long-term benefit.

🙋♀️ If you pay, then your pay attention

Everybody likes free things in life! A complimentary upgrade in a flight is always welcome. We’re happy to pick up “buy one, get one free” items in a store or it’s great that we have so many no-cost learning resources these days on the internet. That said, when you make an investment, you tend to sit up and notice more. It might be because you want to make sure you get value for your money (and time and effort) or because you value what you pay for more or it’s a material as well as psychological message to yourself that you want to commit to making results happen.

🙋♀️ Rather than earn and spend, invest and grow

One of the reasons I reached out to Allegra is because I’ve listened to several of her podcasts and she really puts focus on the numbers. For example, one of her posts on Instagram points out that a $1,000 initial investment with an average monthly contribution of $350 compounded with an average return of 8% per year leads to $536,136 after 30 years. We talked about the theory of “opportunity cost” and how Allegra suggests thinking about your money differently. Rather than simply spending it mindlessly, consider that when the money is spent, it is “tethered” to that one outcome. On the other hand, if you can invest it and grow it, then that money increase in value and over you more choices and impact.

Source: Factora Wealth Instagram

🙋♀️ Transform your finances with small decisions and big automation

People are busy these days and there are lots of demands on them as well as their time. Allegra explains that if you don’t set up direct debits out of your everyday account for when your salary arrives, then you’re simply relying on willpower and the time to make manual interventions at the end of the month. Both can be in short supply! Instead, make decisions once and put them on autopilot by setting up automation to implement those decisions over and over e.g. to move y% of your money into a market account or ask your company to put z% of your salary into your pension before it even makes it on to your paycheck.

Following on from this highly practical discussion, I then elaborated on four key ways that you can handle “imperfection with money” through using the VectorVest system.

- Recognize that you’re being paid to take the risk.

In contrast to putting your money in a savings account, the stock market generates higher returns to compensate you for the uncertainty of what your money will be worth at a date in the future. For example, in the ten years from the first trading day in 2011 to the last one of 2020, the European VectorVest Composite delivered 8.26% per year (excluding dividends). Remember this included the European debt crisis, Brexit, the COVID-19 pandemic, geopolitical tensions, the flash crash, etc! Despite all of this, there was an array of companies across the Eurozone that brought earnings and dividends year over year.

- Let diversification help you overcome the anxiety of picking the perfect stock

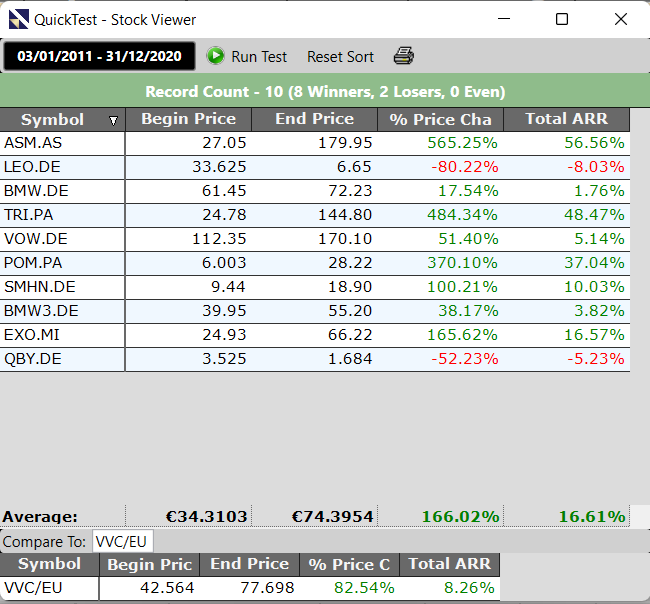

Even if you picked the ideal Unisearch to screen the entire stock market and exhausted every stock analysis tool you could imagine, it’s impossible to say today that your stock(s) will rise tomorrow (and that’s where the basis of my earlier point comes from!). Rather than try to pick perfect investments, pick a range of companies that meet the criteria that suits you. For example, the top ten VST stocks at VectorVest are listed because of their solid combination of value, safety, and timing. This metric combines both fundamental and technical analysis. I have rigorously tested this using over 15 years of data and combined it with a market timing indicator. If I pick the earliest date in the system for the start date of the test in the European market i.e. 21 June 2005 and I ran the test up to the close of 20th June 2022, here are the results:

– A (sparkling!) 24.68% annual rate of return (ARR).

– The Maximum Drawdown was (a fairly reasonable) 29.20%.

– As I often see in BackTests, more stocks lost than won (i.e. 46.92% of the stocks were winners). However, and this is a super important point, the winners delivered gains that far outweighed the losses of those that fell in price. So much so, that over that period, the initial capital grew 419.92%.

– Remember this didn’t even include all of the dividends that could be collected over the years and even better if they were reinvested.

- Pick a simple route to get started that is robust enough to let you learn

In the episode, I referred back to when I led the conversation with Glenn Tompkins about “how to talk to your kids about money”. It’s been one of the most popular themes of the show to date and partly, this is due to the simplicity of how you communicate to young people about money. You might suggest to them that they create a Watchlist for a while first and watch how prices go up and down before committing any real money to the market. Alternatively, they might buy a broad-based ETF that is low-cost, spans the globe, or a very big market and is easy to track. What works for our youngest investors works for anybody wondering how to get off the ground. Of course, the VectorVest Model Portfolios also offer clear ideas. You don’t need the perfect start… you can just start in such a way that is controlled so that you’re not taking big bets and learning a lot about yourself and the market along the way.

- Use a stop loss to navigate the downside

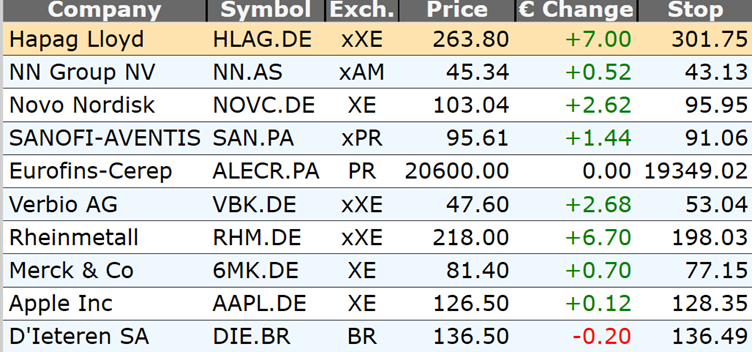

Stocks can fall and indeed, whole markets can fall. You don’t have to watch your laptop all day waiting for the stock exchange to close so you can breathe again. A stop loss is a tool designed to trigger a sell order when your position reaches a certain stage so that you can get out automatically. VectorVest puts forward a stop for every single stock and ETF in each of its databases. Specifically, it’s derived as a 13-week moving average adjusted for risk. The better the fundamentals, the wider the stop (and vice versa). Here is a list of stocks, their prices, and their stop losses as of 20th June 2022. You will see the margin of error that each one has in comparison to where it’s trading at that time. If the price has already fallen below that stop loss, a Sell recommendation will appear.

I really enjoyed talking to Allegra and we had so much to talk about that we couldn’t fit it all in! Please do come back next time for the next episode of Fantastic Female Fridays and to set an automatic reminder, subscribe to our channel on YouTube.

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.