Brady Corporation (BRC) opened up Tuesday’s trading session with a bang. The company reported record earnings for the fiscal fourth quarter, released its fiscal 2024 earnings outlook, and expanded its share buyback program. BRC has gained more than 12% so far this morning as a result.

The company, which operates in the Identification Solutions (IDS) and Workplace Safety (WPS) segments, grew sales 6.8% for the fiscal fourth quarter up to $345.9 million. Profitability climbed as well, up to $49.4 million from just $41.1 million this time last year.

Brady’s diluted EPS of $1.00 represents an increase of 23.5% year over year and also happens to be an all-time high for the company. Last year, the company’s EPS was just $0.81.

In looking at the year as a whole, Brady grew sales by 2.3% and reported an EPS of $3.51 – another all-time high in the full-year viewpoint.

The company also announced its intention to expand its share buyback program last week before the long weekend. Brady’s board of directors approved an additional $100 million of Class A Common Stock for repurchase.

But, that’s not all. The company also released its fiscal 2024 full-year outlook, and investors can expect the momentum gained in 2023 to continue. The forecasted EPS range of $3.70 to $3.95 would be a 5.4% to 12.5% increase year over year.

After returning more than $120 million to shareholders in 2023, the company is in a financially stable position and poised to continue rewarding investors while taking advantage of new investment opportunities.

That being said, is there still room for growth in this stock to justify adding it to your portfolio? We’ve taken a look through the VectorVest stock analysis software and have 3 things you are going to want to see if you’re interested in this stock…

BRC Has Very Good Upside Potential, Good Safety, and Excellent Timing

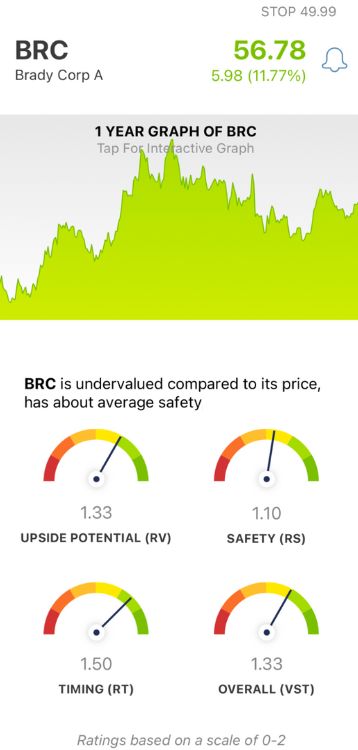

The VectorVest system simplifies your approach to analysis by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average. But it gets even easier - because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation at any given time. As for BRC, here’s what we found:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. As for BRC, the RV rating of 1.33 is very good. Furthermore, the stock is undervalued even at today’s price of $56.78. The current value is $71.12.

- Good Safety: The RS rating is an indicator of risk, and takes into account the financial consistency & predictability of a company along with its debt-to-equity ratio and business longevity. As for BRC, the RS rating of 1.10 is considered good.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of a stock’s price movement and is taken day over day, week over week, quarter over quarter, and year over year. As you can see by looking at how BRC has performed recently, the stock has excellent timing - with an RT rating of 1.50.

The overall VST rating of 1.33 is very good for BRC - so, where does that leave you as an investor or prospective trader?

No need to play the guessing game or let emotion influence your decision-making. Get a clear buy, sell, or hold recommendation based on a tried-and-true system that has outperformed the S&P 500 index by 10x over the past two decades and counting. A free stock analysis is just a click away at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BRC has climbed 12% so far in Tuesday’s trading session after reporting record earnings, providing an optimistic outlook for the year ahead, and expanding its share buyback program. The stock has very good upside potential, good safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.