Earlier this week, Plug Power (PLUG) had its analyst day. The company’s executives laid out plans to reach long-term goals, and the findings were certainly intriguing.

By 2030, the alternative energy company expects to produce more than 2,000 tons of hydrogen daily – all through its green-hydrogen network. And, that’s just the beginning.

Plug Power expects to deploy stationary power products totaling one gigawatt while shipping out five gigawatts of electrolyzers annually. Meanwhile, the company’s fuel-cell-powered forklift trucks will play a key role in reaching 2030 targets too. The goal is to deliver 500k of these trucks.

But, one of the biggest takeaways from Wednesday was the company teasing a new product on the horizon: a portable hydrogen refueler. Plug Power says the product will be called HL 1500. And while production isn’t finished yet, the company already has deals with 3 different transit systems.

Leading into the next earnings day in August, Plug Power expects to report another quarter of growth. EPS should rise along with revenue – with the initial projects of 13.33% growth and 65.76% growth year over year respectively.

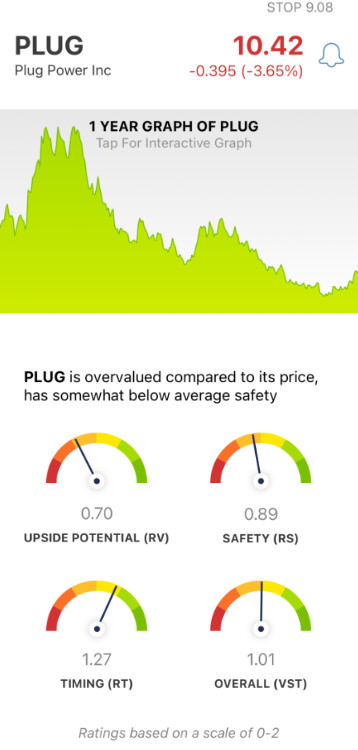

While the stock reached a high of $66/share back in 2021, the fall to earth has been dramatic since then. Today, share prices rest at a mere $10.42. But, it appears the company is on the right path based on all this information.

And while the losses have been mounting this year as the company is down 12% so far, the hype around analyst day created a positive price trend leading up to this week. Share prices are up 33% in the past month.

So, what should you do with this opportunity as an investor? Will this trend hold? Is now a good time to buy PLUG? We’ve analyzed this stock through the VectorVest stock forecasting software and have 3 things we want to show you to help you make your next move with confidence.

While PLUG Has Poor Upside Potential, the Stock Has Fair Safety and Very Good Timing

VectorVest uses a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - empowering you to win more trades with less work. You’re given all the information you need to make clear, calculated moves with just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average. But the real kicker is that based on these ratings, the system gives you a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for PLUG, here’s what we found:

- Poor Upside Potential: The RV rating assesses a company’s long-term price appreciation potential, comparing it to AAA corporate bond rates and risk. And right now, the stock has a poor RV rating of 0.70. Further to that point, the stock is overvalued - with a current value of $5.72.

- Fair Safety: In terms of risk, PLUG is fairly safe - even though the RS rating of 0.89 is below the average. This rating is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: The one thing PLUG has going for it is very good timing - as the stock has been climbing higher and higher over the past 4+ weeks. As a result, the stock has a very good RT rating of 1.27. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.01 is just above the average and deemed to be fair. But where does that leave you as an investor - is PLUG considered a buy, sell, or hold right now? A clear answer awaits you at VectorVest. Get a free stock analysis today and make your decision confidently one way or the other!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for PLUG, the company is headed on the right trajectory - but as of now, the upside potential is poor. Nevertheless, the stock has fair safety and very good timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.