One of today’s biggest movers in Monday morning’s trading session is cybersecurity company Zscaler (ZS). The stock has climbed more than 22% after raising guidance and resetting expectations for the fiscal third-quarter earnings report.

This came as a result of a dramatic increase in revenue expectations. Previously, Zscaler was looking to produce revenue somewhere between $396 million and $398 million. Now, that figure has jumped to a range of $415 million to $419 million.

Even the forecast on adjusted income from operations has been raised. The company is looking to log somewhere between $60 million to $64 million, up from the previously anticipated $55 million to $56 million.

Still, Zscaler expects to report a GAAP loss from operations of $55 million to $59 million. However, the updated forecast is undoubtedly a positive sign for investors. CEO Jay Chaudhry says this is the result of an impressive finish to the quarter, as customers and prospects are buying into the high ROI promised in the Zscaler Zero Trust Exchange platform.

On top of all this, Zscaler took the opportunity to raise the full-year revenue forecast from $1.558 billion-$1.563 billion up to $1.587 billion-$1.591 billion. And, adjusted income from operations will be up for the year as well – raised from $213 million-$215 million to $220 million-$224 million.

Investors are hopeful that today’s momentum will stick and continue pushing the stock in the right direction. ZS had been falling in the wrong direction for some time – with a 17% loss in the last 3 months even after today’s trading session.

With that said, is it worth adding ZS to your portfolio ahead of the 3rd quarter earnings report that is set to be released on June 1st? Before you decide one way or the other, you will want to see what we’ve uncovered through the VectorVest stock analyzing software…

While Today’s News Has Led to Fair Timing For ZS, the Stock Still Has Poor Upside Potential & Safety

The VectorVest system helps simplify your approach to finding and analyzing opportunities in the stock market. You can gain clear, actionable insights through the proprietary stock-rating system. It’s all based on 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

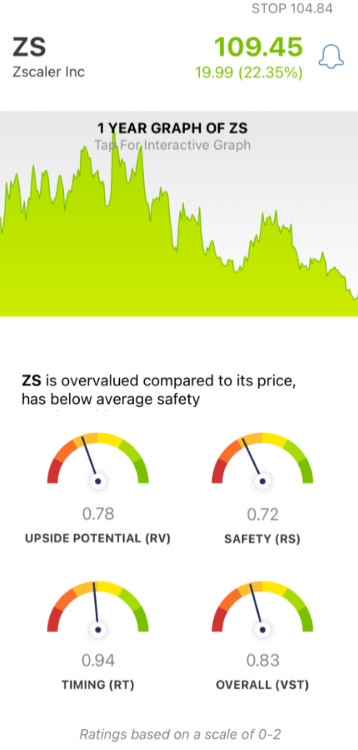

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. And based on the overall VST rating for a given stock, the VectorVest system can offer a clear buy, sell, or hold recommendation to help you make your next move with confidence. As for ZS, here’s what you need to know:

- Poor Upside Potential: Despite the raised forecast for the current quarter and the full year, the RV rating of 0.78 is still considered poor. This is a comparison of the company’s 3-year price projection alongside AAA corporate bond rates and risk. Plus, the stock is way overvalued at today’s price - with a current value of just $17.

- Poor Safety: In terms of risk, ZS has poor safety. The RS rating of 0.72 is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: While the stock has definitely turned things around in today’s trading session, the RT rating of 0.94 is still below the average - but considered fair nonetheless. The stock has quite the hole to climb out of after losing more than 35% over a three-month span. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.83 is poor for ZS. So, does that mean you should find another opportunity for the time being - or is this a good time to get into the stock? And if you’re currently invested in this stock, does it mean it’s time to sell?

Don’t play the guessing game or make your next move based on emotion. Get a clear buy, sell, or hold recommendation through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite today’s impressive turnaround for ZS, the stock still has poor upside potential and safety - and the timing is just fair right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.