Tuesday morning’s trading session was a whirlwind of emotions for investors of Getty Images (GETY) after an activist shareholder made it clear that the current state of the company wasn’t cutting it.

While shares initially shot 5.7% higher in premarket trading, they fell the same amount once the market opened – as they currently sit 5.4% lower. All of this because Trillium Capital LLC – an activist shareholder which owns hundreds of thousands of GETY shares – urged the company to sell.

Trillium claims that the company’s board has dropped the ball when obvious opportunities to increase shareholder value have presented themselves. The company went public just under a year ago, IPOing at $9.39. At one point, GETY shares reached a height of more than $30/share.

Today, though, the stock sits at a mere $6.15/share. This is an 80% drop from the stock’s price in August of 2022. Adding to Trillium’s stance, the investor states that Getty Images should be valued as high as $1.1b beyond its current valuation today. And, the stock price should be at least 100% higher.

Trillium’s call to action included an array of recommendations. These included an acquisition of the company by a more strategic buyer – or better yet, a sale to a private equity player which would allow the three largest shareholders to take the company private.

Before Trillium released this statement and sent shares tumbling the other way, though, GETY was actually on the up and up over the past few months. Just in the past 30 days, the stock has climbed 27%. Nevertheless, we’ve taken a look at the stock through the VectorVest stock analyzer software and see 3 major issues that investors (or potential investors) need to be aware of.

Despite Excellent Timing, GETY Has Poor Safety & Very Poor Upside Potential

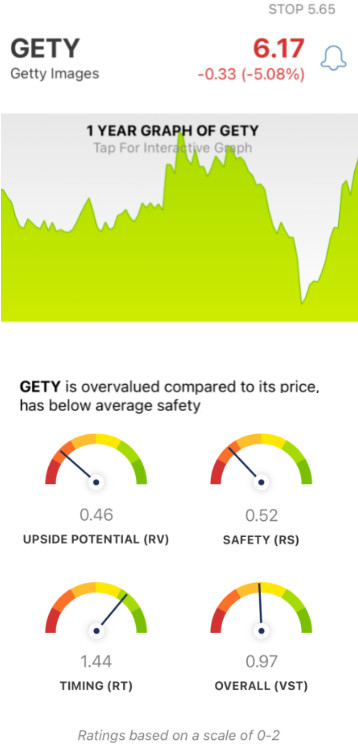

The VectorVest system simplifies your trading strategy by giving you all the insights you need to make informed, confident decisions with just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation easy. But it gets even easier. Because based on the overall VST rating for a stock, VectorVest issues a clear buy, sell, or hold recommendation at any given time. As for GETY, here’s what we found:

- Very Poor Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential in comparison to AAA corporate bond rates and risk. And right now, the RV rating of 0.46 is very poor. Adding to that, the stock is overvalued at today’s price of $5.98 a share. The current value is a mere $1.60/share.

- Poor Safety: In terms of risk, GETY has poor safety - with an RS rating of 0.52 This rating is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing GETY has going for it (which Trillium’s demand may have reversed today) is timing. The RT rating of 1.44 is excellent - and is derived from the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for GETY is fair at 0.97 But, this is only being held together by the strong price trend that has been pushing GETY shares higher over the past few months. Will the negative press and market reaction from today reverse that trend, pushing shares back down lower and lower?

If you’re invested in GETY or are looking for an opportunity, a free stock analysis at VectorVest will help you make your next move without any guesswork or emotion. Simplify your trading strategy today and win more trades with less work!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for GETY, it has very poor upside potential and poor safety. It did have excellent timing coming into today - but that price tend could be on the verge of turning around. You’ll want to stay up to date with VectorVest so you never get left holding the bag.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.