Yesterday morning, Alkaline Water (WTER) announced approval by the board of directors for a 15-for-1 reverse stock split. This is effective under Nevada law as of today (April 5).

The implications of this move include a dramatic reduction of common stock shares on the market. Before the reverse stock split, 200,000,000 shares of common stock were in circulation. Today, that figure has been cut to a mere 13,333,333 shares of common stock. Each of these has a par value of $0.001 per share.

This decision was made with the goal of increasing the price per share of the company’s common stock. The stock had fallen below the minimum bid price requirement to remain on the Nasdaq – $1.00/share. After the IPO at around $5/share, it’s been a steady drop to the bottom. The company’s low point came yesterday when shares fell to just $0.11/share.

The market initially responded negatively to this news, sending shares more than 20% lower. And today in Wednesday morning’s trading session, that trend continued. The stock slid an additional 23% before fully recovering and heading back up in the right direction.

Whether the stock will continue climbing or not remains to be seen. However, one thing is for sure – there are 3 red flags we’ve uncovered through the VectorVest stock analyzing software that you need to see. If you’re currently invested in WTER or are pondering the possibility of buying in at this low point, read on below…

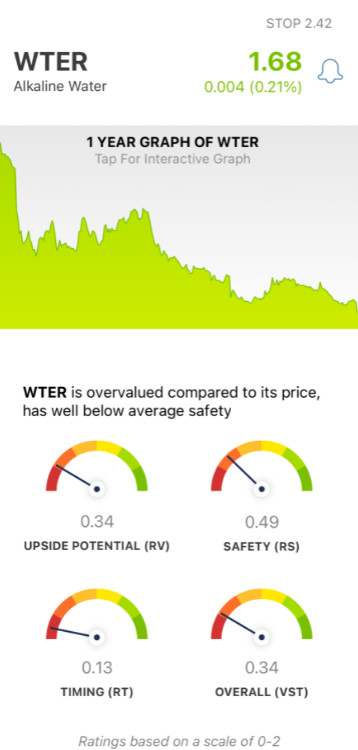

Even After the Reverse Stock Split, WTER Still Has Very Poor Upside Potential, Safety, and Timing

The VectorVest system helps you simplify your trading strategy to win more trades with less work. This is possible through a proprietary stock rating system that gives you all the insights you need in just three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings is placed on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy. But taking things a step further, VectorVest provides you with a clear buy, sell, or hold recommendation based on these ratings.

You never have to play the guessing game or let emotion influence your decision-making again. As for WTER, here are the 3 major red flags we mentioned earlier…

- Very Poor Upside Potential: The RV rating assesses a stock’s 3-year price appreciation potential compared to AAA corporate bond rates and risk. And right now, the RV rating of 0.34 is very poor for WTER. What’s more, the stock is still overvalued at its current price. The current value is a mere $0.28/share.

- Very Poor Safety: In terms of risk, WTER has very poor safety - as evidenced by the RS rating of 0.49. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: To top it all off, the timing is very poor for WTER right now - with an RT rating of just 0.13. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for WTER is very poor at just 0.34. So - does that mean it’s officially time to cut losses on this stock? Or, is this reverse stock split going to provide the relief investors have been anxiously anticipating? Get a clear buy, sell, or hold recommendation for WTER today with a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for WTER, it has very poor upside potential, safety, and timing. The reverse stock split may not be enough to save this company - and investors need to be aware of this.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.