It’s been reported that First Citizens Bank (FCNCA) has thrown its hat in the ring in an effort to acquire the recently failed Silicon Valley Bank (SVB). Rumor has it that on Sunday, the Raleigh, North Carolina-based lending & banking company submitted a bid to buy all of SVB. But, as of right now, this is nothing more than that: a rumor.

While a company spokesperson issued a statement refusing to comment on market rumors or speculation, the FDIC has reported that multiple parties are interested in SVB. It’s no secret that the FDIC wants SVB – now known as Silicon Valley Bridge Bank – off their plate. They’re trying to find a willing buyer, and are taking bids from all qualified financial institutions.

The stake right now isn’t just for one bank either – but two. While Silicon Valley Bridge Bank is the topic of discussion today, there’s also the opportunity for financial institutions to purchase SVB Private Bank.

But according to a source close to First Citizens Bank, the financial institution wants the entire pie – not just a slice. They’re submitting separate bids for both Silicon Valley Bridge Bank and SVB Private Bank, along with a third bid for the entire company.

The FDIC will begin taking bids on Wednesday, with a deadline for bids of Friday at 8PM EST. While we don’t have any concrete evidence linking First Citizens Bank to these acquisition rumors, we do know that it makes sense. This is the 30th largest commercial bank in the country, boasting over $109 billion in assets.

Those currently invested in FCNCA – or those wondering if now is a good time to buy FCNCA – should pay close attention in the coming days to see what comes of these rumors.

The company has experienced some serious highs and lows over the past week, as FCNCA dipped 33% after the SVB run, along with other financial institutions like Charles Schwab and First Republic Bank. But in the last week, FCNCA has climbed back up 7%. At one point today, the stock jumped another 6% before settling around 3% at the time of this conversation.

With all that said, we’ve got something you need to see in regard to FCNCA – regardless of SVB acquisition rumors. Here’s what we’ve uncovered through the VectorVest stock analyzer software…

FCNCA Has Excellent Upside Potential and Good Safety - But it’s Being Held Back By Poor Timing Right Now

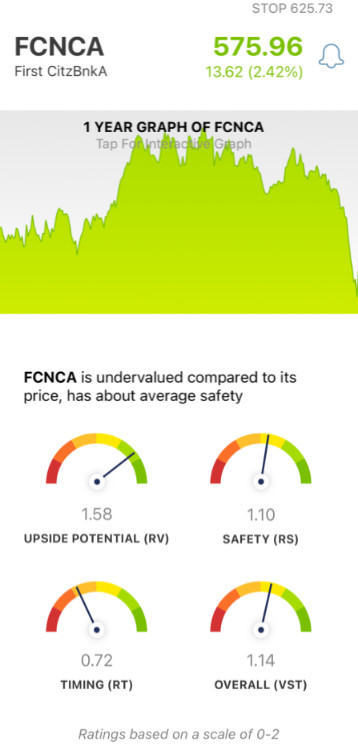

The VectorVest system simplifies your trading strategy by giving you all the insights you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Interpreting these is easy as they sit on a scale of 0.00-2.00 with 1.00 being the average.

But to make things even easier for investors, VectorVest provides a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock, at any given time. As for FCNCA, here’s the current situation:

- Excellent Upside Potential: The RV rating of 1.58 is excellent for FCNCA - which is calculated by comparing the stock’s 3-year price appreciation projection to AAA corporate bond rates and risk. And, the stock is way undervalued at today’s price. The current value of this stock is $950.94.

- Good Safety: Despite the stigma around financial institutions right now, FCNCA still has good safety with an RS rating of 1.10. This is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The one thing holding this stock back right now is the poor RT rating of 0.72 - which is derived based on the direction, dynamics, and magnitude of the stock’s price movement. But if the trend that’s formed over the past week can strengthen, this rating could move back in the right direction and really change things for potential investors.

All things considered, the overall VST rating for FCNCA is 1.14 - which is good. But is it enough to earn a buy? Or, should you wait to see how the stock’s price trend performs in the coming days before making a move? You can get a clear answer on your next move and make it with confidence by getting a free stock analysis at VectorVest. You’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for FCNCA, it is undervalued with excellent upside potential and good safety - but it is being held back by poor timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.