Written by: Angela Akers

Dr. DiLiddo introduced us to the Investment Matrix decades ago in his classic little green book, “Stocks, Strategies & Common Sense.”

“Without knowing it, each of us has an investment style which is distinctly our own.” – Dr. Bart DiLiddo

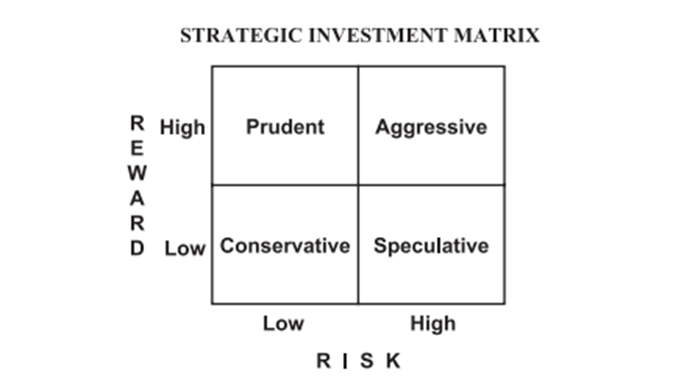

The four basic investment styles are categorized by using two of our key proprietary fundamental indicators, Relative Value, RV, which measures the long-term price appreciation potential of a company and Relative Safety, RS, which is an indicator of risk and measures the consistency and predictability of a company’s financial performance. Both of these indicators are measured on a 0.00 – 2.00 scale with values above 1.00 being favorable and values below 1.00 being unfavorable.

If you’re not familiar with these indicators, here are some quick refreshers:

• Relative Safety

• Relative Value

Three weeks ago, we studied the high risk, high reward Aggressive Investor. Two weeks ago, we examined the low risk, low reward Conservative Investor. Last week, we reviewed the low risk, high reward Prudent Investor. So, the final quadrant in the Investment Matrix is the Speculative Investor.

The Speculative Investor is the gambler. They are high risk, low reward investors. They’re betting that the risk they take will pay off in spades. They love the thrill and excitement of making the quick buck. They’re meme-stock lovers with volatility being the name of the game. They have no regard for value or safety. The stocks that fall in line with the Speculative investment style are characterized in VectorVest by having a Relative Value, RV, below 1.00 and a Relative Safety, RS, below 1.00. Because speculators are enamored by big price fluctuations and the potential to lose money is high, to be successful, they must pay close attention to changes in momentum. Looking for divergences between price and Relative Timing, RT, is vital for the nimble speculator.

You can find Speculative stocks in VectorVest by clicking on the UniSearch tab of VV7 and selecting the Searches – Speculative group from the list on the lefthand side of the screen. You’ll find 12 Long Searches and 2 Short Searches in this list that will help you find the best stocks to fit the Speculative investment style. Speculative investors often disregard Market Timing as price and volume spikes get their attention no matter what the broad market is doing.

Make sure you watch tonight’s “Special Presentation” where Mr. Steve Chappell will help you navigate the Speculative approach. Are You A Speculative Investor?

*There are heavy risks associated with buying stocks when the market is falling. VectorVest advises against this practice.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment