It’s been a tough few years for Uber (UBER) investors. But, the stock has been rallying for most of 2023 and looks to be back and better than ever. The latest company earnings represent a huge milestone – the company’s first profitable quarter.

After years and years of investing in the business, Uber is finally in the green. The ride-sharing company posted a GAAP operating profit of $326 million for the second quarter.

And, there’s reason to believe this is just the first profitable quarter of many. CFO Nelson Chai mentioned that shareholders will likely start to see dividends in the coming quarters as cash flow continues to climb.

This is in stark contrast to where the company sat this time last year, at which point Uber posted a net loss of $2.6 billion. Interestingly enough, though, this time last year is when the company began its monumental climb back in the right direction. The stock is up 62% since then.

Revenue for this quarter grew from $8.07 billion last year to $9.23 billion this year. This fell just shy of the analyst estimate of $9.34 billion. This narrow underperformance could be why we’ve seen share prices falling despite the excitement over the company’s first profitable quarter.

Looking ahead, Uber expects the third quarter to be profitable as well. It is forecasting $975 million to $1.025 billion in adjusted earnings, powered by $34 billion to $35 billion in gross bookings. This is right in line with what the FactSet consensus is looking for.

There’s no denying the hype forming around UBER right now, despite the 4% loss the company’s stock took this week. That being said, what should current or prospective investors do with this information? Is this your sign to buy UBER, or is there a reason to be skeptical?

We’ve taken a look at the stock through VectorVest’s stock analysis software and have 3 things to show you that will help you feel more confident and clear in your next move.

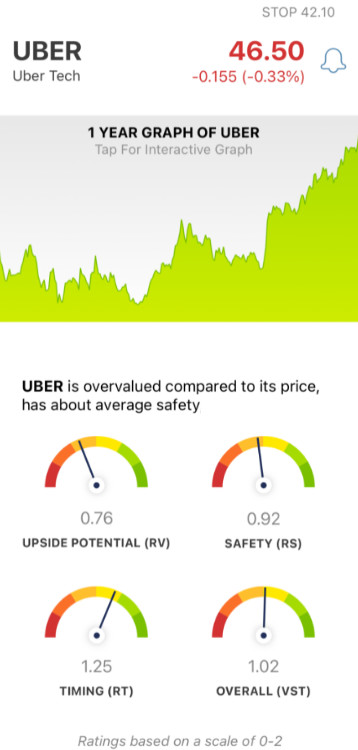

While UBER Has Poor Upside Potential, the Stock Has Fair Safety and Good Timing

The VectorVest system helps you win more trades with less work by giving you clear, actionable insights in just 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy.

But, it gets even better. Because based on the overall VST rating for a given stock, the system issues a buy, sell, or hold recommendation - at any given time. As for UBER, here’s what we’ve uncovered:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. It offers far better insights than a simple comparison of price to value alone. And right now, the RV rating of 0.76 is poor. What’s more, the stock is overvalued by a good margin - with a current value of just $5.28.

- Fair Safety: In terms of risk, though, UBER is a fairly safe stock with an RS rating of 0.92. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: Even though share prices took a dip in the past week, UBER still has a good RT rating of 1.25 - suggesting the positive price trend we’ve witnessed over the last year remains strong. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.02 is just above the average for UBER and is considered fair. Is it enough to justify buying the stock or bolstering your current position? Or, is this suggesting you should hold off on making a move either way?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UBER stock took a dip after the company’s second-quarter earnings, and it still has poor upside potential. That being said, the stock’s fairly safe and it has good timing, too.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment