After 3 consecutive quarters of declining revenue, the Facebook parent company Meta (META) finally turned things around. Wednesday, the company reported a 3% growth in sales that dramatically outperformed analyst expectations.

On top of revenue growth, the company saw user growth that outperformed recent quarters. And looking ahead to the next quarter, Zuckerberg is expecting another quarter of revenue growth.

While one of the biggest investments within Meta recently has been the Metaverse, the company is also dabbling in AI – following suit with other tech companies.

But, the Facebook parent company is being much more strategic with how they spend money to align with efforts to restructure, after being hit by a myriad of challenges recently – from a more competitive ad environment to looming recession fears.

Thus, the goal for Meta in the remainder of 2023 is to become more efficient – as profitability has declined nearly a quarter year over year. The company announced last year that 11,000 jobs would be cut, and just recently, Zuckerberg said that 10,000 more people would be laid off.

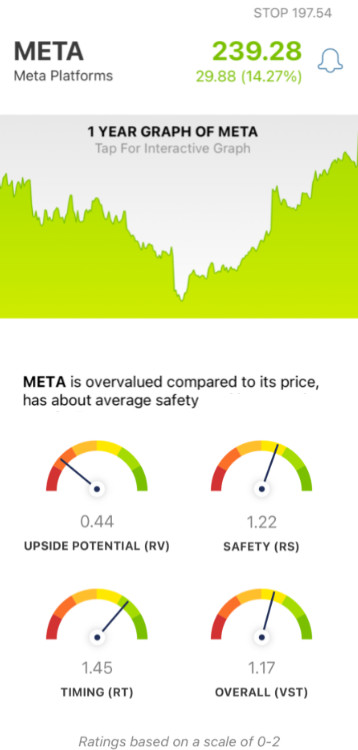

As a result of all this, META stock is up over 14% so far in Thursday morning’s trading session. The stock was already trending in the right direction over the past few months and is now up 65% since mid to late January.

So – does that mean you should add META to your portfolio if you don’t currently have an open position? And, if you do already own META, should you pick up more shares or sell off your position at the stock’s highest point since February of 2022?

You’ve got questions, we’ve got answers. Below, we’ll break down the 3 most important things we uncovered through the VectorVest stock analyzing software to help you make a clear, emotionless decision on your next move.

Despite Very Poor Upside Potential, META Has Good Safety & Excellent Timing

The VectorVest system allows you to simplify your trading strategy to win more trades with less work - and less stress and uncertainty along the way.

It’s all possible through the proprietary stock rating system, which uses just 3 ratings to give you all the insights you need. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. But, based on these ratings, VectorVest offers you a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for META, here’s what you need to know after the most recent earnings report:

- Very Poor Upside Potential: The RV rating compares a stock’s 3-year price appreciation potential to AAA corporate bond rates and risk, offering a more accurate insight than a simple comparison of price and value alone. And right now, the RV rating of 0.44 is very poor. And, the stock is overvalued at today’s price of $239. The current value is just $88.

- Good Safety: In terms of risk, META has good safety - with an RS rating of 1.22. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The timing for META is excellent right now - as confirmed by the RT rating of 1.45. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.17 is good for META - but is it enough to earn the stock a buy rating?

No need to play the guessing game or let emotion influence your decision-making - follow a tried-and-true system that has outperformed the S&P 500 by 10x over the past two decades! If you’re wondering what your next move should be with this company, get a free stock analysis today at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. And despite the very poor upside potential for META, it still has good safety and excellent timing - with a price trend that has been strengthened further as a result of 1st quarter earnings.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment