Friday’s trading session saw Lyft stock fall off a cliff after the ride-share company released its fiscal fourth-quarter earnings report for 2022. Shares dropped nearly 40% not necessarily because the company underperformed in the 4th quarter – but because they expect issues to persist into 2023.

Lyft reported earnings per share of $0.29, which was more than double the analyst expectation of $0.13 per share. Revenue was a slightly pleasant surprise as well, as the company reported $1.18 billion compared to the $1.16 billion experts were anticipating. This figure is up 21% from the same period last year.

The problem, though, is in the outlook for the fiscal first quarter of 2023. Lyft is projecting revenue of just $975 million – much lower than analysts anticipated ($1.09 billion).

CFO Elaine Paul says this is merely seasonality at play. This period historically sees lower prices and fewer Prime Time rates. And, Lyft’s insurance renewal timing will also put pressure on the P&L sheet.

The company is also suffering from profitability woes. Lyft reported a net loss of $588.1 million in the fiscal fourth quarter, which is nearly double the loss they took the year prior. It’s worth noting that restructuring efforts are in place now, which were kicked off last November. These will bring operating costs down with no impact on operations. But time is not on the company’s side.

And, in comparing Lyft to Uber (who just reported their strongest quarter ever), it’s clear that the issue is with the company – not the economy or segment itself. When we reviewed LYFT stock last November, it was sinking after an earning report – and matters have only gotten worse since then.

With all of this said, is it officially time for you to cut losses on LYFT? Or, is this steep dropoff present an opportunity for you to buy shares at a discount? Below, you’ll gain access to three key insights on this stock through the VectorVest stock analysis software.

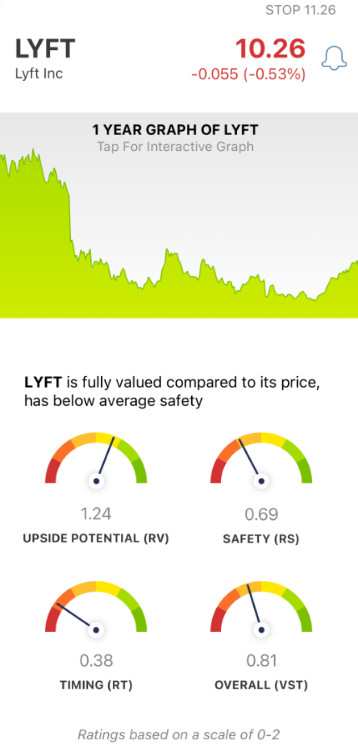

Despite Good Upside Potential, LYFT Has Poor Safety with Very Poor Timing

The VectorVest system makes uncovering and analyzing opportunities in the stock market as simple and straightforward as possible. It saves you time while preventing costly mistakes. You’re literally told what to buy, when to buy it, and when to sell it – what more could you ask for?

It’s all possible through three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 with 1.00 being the average – making interpretation quick and easy. And based on these ratings, VectorVest issues a clear buy, sell, or hold recommendation. As for LYFT, here’s the current situation:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. As for LYFT, the RV rating of 1.24 is actually quite good. What’s more, the stock is fully valued at its current price point.

- Poor Safety: One issue with LYFT is its risk. Right now, the stock has a poor RS rating of 0.69. This rating is calculated from a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

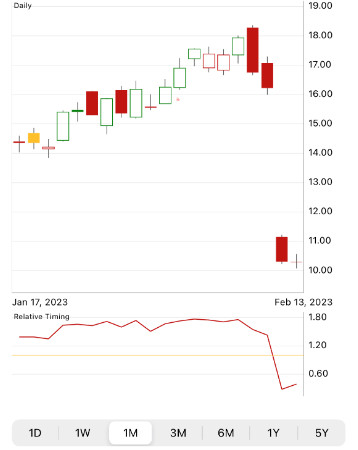

- Very Poor Timing: The biggest issue for LYFT right now is the negative price trend that has taken hold of the stock, resulting in a very poor RT rating of 0.38. This is derived from the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 0.81 – which is poor. Does that mean it’s time to sell now? Don’t play the guessing game or let emotion influence your decision-making – get a clear answer on your next move through a free stock analysis today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, LYFT has good upside potential – but that’s where the positive news ends. The stock has poor safety and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment