Just last month Dell Technologies (DELL) reported first-quarter earnings that fell short of Wall Street’s expectations, taking the stock down from its all-time high of $179/share. It fell more than 30% in just a few days, eroding market cap and scaring investors out of their positions.

The issue was that despite AI growth fueling the top and bottom lines, the company delivered an outlook well under the consensus for both the current quarter and the full fiscal year. Here’s what was forecasted:

Q2:

- Revenue: $24 billion vs $23.35 billion

- EPS: $1.65 vs $1.88 expected

Full Year:

- Revenue: $95.5 billion vs $96.64 billion expected

- EPS: $7.65 vs $7.74 expected

But, the road to recovery is well underway. In the last week, DELL has climbed nearly 14%. It’s up 5% alone today. Analysts are starting to change their tune on the stock after closer examination.

For example, Bank of America analyst Wamsi Mohan says there is plenty of room for margin growth, which is mainly what is holding the stock back right now.

There was a recent meeting with management in which it became apparent that services, consulting, support, and related areas were deferred on the balance sheet and will become recognized in the long run.

There’s also reason to believe we’ll see a surge in customers upgrading to more efficient liquid-cooling servers that provide a higher ROI as power costs continue to climb.

All this considered, Mohan sees great potential for Dell over the coming years – and he’s not alone. Erik Woodring with Morgan Stanley echoed this sentiment saying that after the management meeting he and his team has heightened confidence in the road ahead.

That being said, is now a good time to buy DELL? We’ve found 3 things in the VectorVest stock software that will help you make your next move one way or the other.

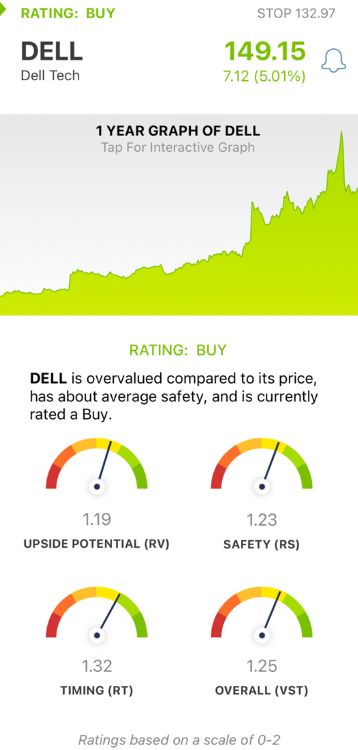

DELL Has Good Upside Potential and Safety With Very Good Timing, Earning the Stock a Buy

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it through a proprietary algorithm. It distills complex technical data into 3 ratings that give you all the insights you need to make calculated decisions.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for effortless interpretation. Better yet, you’re offered a clear buy, sell, or hold based on the stock’s overall VST rating. Here’s the outlook for DELL:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers way better insight than the typical comparison of price to value alone. As for DELL, the RV rating of 1.19 is good.

- Good Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.23 is good for DELL.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year, offering the full view for investors. DELL has a very good RT rating of 1.32, reflecting its recent turnaround.

The overall VST rating of 1.25 is very good for DELL, enough to earn the stock a BUY recommendation. But before you make your next move, look over this free stock analysis for deeper insights that leave you confident and clear in your decision. Transform your trading strategy with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DELL dropped after the most recent earnings, but has started climbing back towards the top, up more than 13% in the past week. This comes on the heels of a management meeting where analysts ended up changing their view on the stock. It has good upside potential and safety with very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment