Boxed – an e-commerce retailer specializing in bulk pantry products – announced today that they are exploring strategic alternatives. Usually, this means the company is looking to be sold and acquired. But, the company continues to look into fundraising initiatives as well. The goal is to announce additional funding in the next 45 days.

In order to assist with these fundraising and acquisition efforts, the company has leveraged the help of financial and legal advisors – showing they’re more serious about a sale than some would have initially thought. But at the current market cap, is this a company worth acquiring?

Boxed went public at a share price of $10.50. Over the last year, though, the company has seen shares plummet a whopping 97% – down to a low point of just $0.19/share at the end of December.

Experts believe that the issue is with Boxed’s business model. The company sells bulk staples direct to consumers. But some believe this company would be better suited with a B2B model – and that could be the reason for looking to go private.

With all this said, today’s news has sent shares trading up almost 30% at one point. As of 11:30 AM EST, the stock sits at around $0.30/share – a gain of 17% on the day. Knowing what could be coming for this company in the future, is this a good time to buy? Or, is the hype around today’s news unsubstantiated? After all, a company hoping to be acquired doesn’t always manifest in a sale.

You don’t have to play the guessing game or let emotion influence your decision-making on this stock. We’ve identified three red flags you need to see – found within the VectorVest stock analysis software.

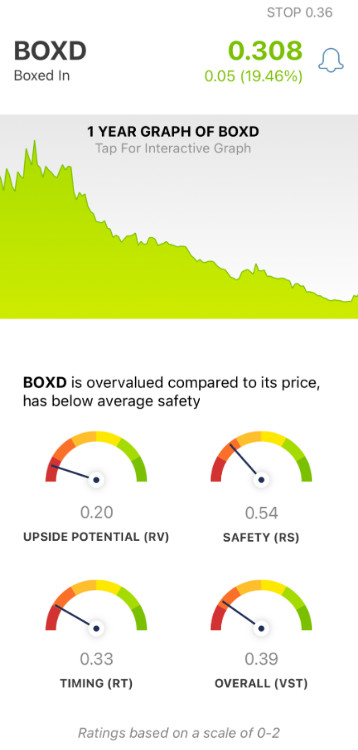

BOXD Has Very Poor Upside Potential & Timing - and Poor Safety to Boot

The VectorVest stock analysis system transforms the way you find and execute opportunities in the stock market. It recommends what to buy, when to buy it, and when to sell it - all with just three simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00 - with 1.00 being the average. Stocks with ratings above the average are overperforming, and vice versa. But to make things even simpler, VectorVest provides a clear buy, sell, or hold recommendation based on these ratings - for any given stock, at any given time. As for BOXD, here’s what investors (and potential investors) need to see:

- Very Poor Upside Potential: In comparing BOXD’s long-term price appreciation potential (3 years) out to AAA corporate bond rates and risk, things are looking abysmal. The RS rating of 0.20 is very poor. And even at this low price point, the stock is overvalued - with a current valuation of just $0.04/share.

- Poor Safety: An indicator of risk, relative safety analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for BOXD, the RS rating of 0.54 is poor.

- Very Poor Timing: Despite the quick pump this morning, the timing for BOXD is very poor - as indicated by the RT rating of 0.33. This rating is calculated based on the direction, dynamics, and magnitude of a stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All this works out to an overall VST rating of 0.39, which is very poor. So - should you sell off any shares you have now and capitalize on today’s news? Or, is there any reason to hold onto hope longer? Get a clear answer on your next move through a free stock analysis.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for BOXD, it is overvalued with very poor upside potential, poor safety, and very poor timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment