Boeing and United Airlines were both in the headlines this Tuesday morning after striking a deal for the sale of 100 Boeing 787 Dreamliners. The deal also carries the option to purchase 100 more 787 Dreamliners at a later date.

While delivery for these 100 aircraft won’t take place until sometime between 2024 and 2032, United Airlines also exercised an option to purchase 44 Boeing 737 Max Aircraft. These will likely come sooner – sometime between 2024-2026.

Executives are referring to this sale as the largest widebody order by a U.S. carrier in commercial aviation history. But, the press release put out by the two companies hasn’t manifested itself in the form of stock movement. In Tuesday’s premarket trading hours, Boeing jumped almost 4% before settling back down and leveling off.

With that said, any sort of win is a positive sign for Boeing right now, a company that is on the road to recovery after being hammered by pandemic restrictions and manufacturing issues – and a deal to produce this many jets will be huge for the company.

Today, the stock sits at around $188/share. A positive price trend has been forming around Boeing stock over the past 3 months. It’s up over 21% in that timeframe. The last time we wrote about Boeing it sat at a much lower price of around $130/share and had a lot of problems – poor upside potential, safety, and timing.

A lot has changed, but we still see two issues with the stock when looking through the VectorVest stock analysis software. Here’s what you need to know before making your next move…

Despite Excellent Timing, BA Stock Still Has Very Poor Upside Potential

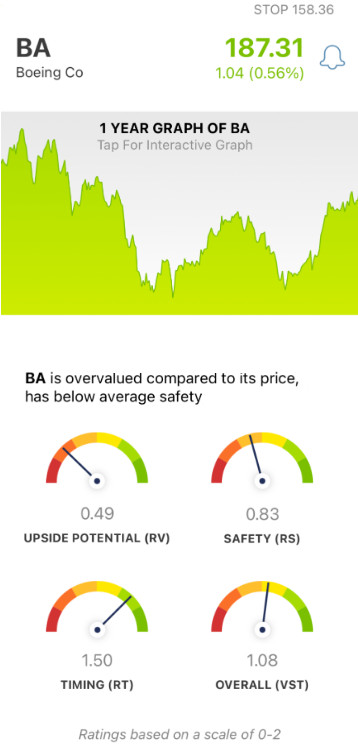

The VectorVest system simplifies trading by telling you everything you need to know about a stock in just three ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Together, these sit on a scale of 0.00-2.00 – with 1.00 being the average. Interpretation is quick and easy, as you just need to pick stocks with higher ratings to win more trades.

But the best part about having VectorVest in your arsenal is the clear buy, sell, or hold recommendation you’re given based on these ratings. No more guesswork or emotional investing – just simple, tried-and-true stock analysis. As for BA stock, here’s the current situation:

- Very Poor Upside Potential: The long-term price appreciation potential has dropped even further since we last wrote about BA stock – likely because the stock price has risen and there’s now very little room for growth. The RV rating of 0.49 is very poor, and the stock is still overvalued – with a current value of just $40.61.

- Poor Safety: In looking at the risk associated with BA, VectorVest has analyzed its financial consistency and predictability, debt-to-equity ratio, and business longevity. All of this works out to a poor RS rating of 0.83.

- Excellent Timing: As we mentioned earlier, there is excellent timing for BA right now and the RT rating of 1.50 reflects that. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture of a stock’s price trend.

All this considered, the overall VST rating for BA is 1.08 – which is fair. But…does that necessarily mean it’s time to buy, or is there not enough room for price appreciation anymore? Get a clear answer on what you should do next with BA stock through our free stock analyzer.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for BA, it is overvalued with very poor upside potential and poor safety, but it does have excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment