by Leslie N. Masonson, MBA

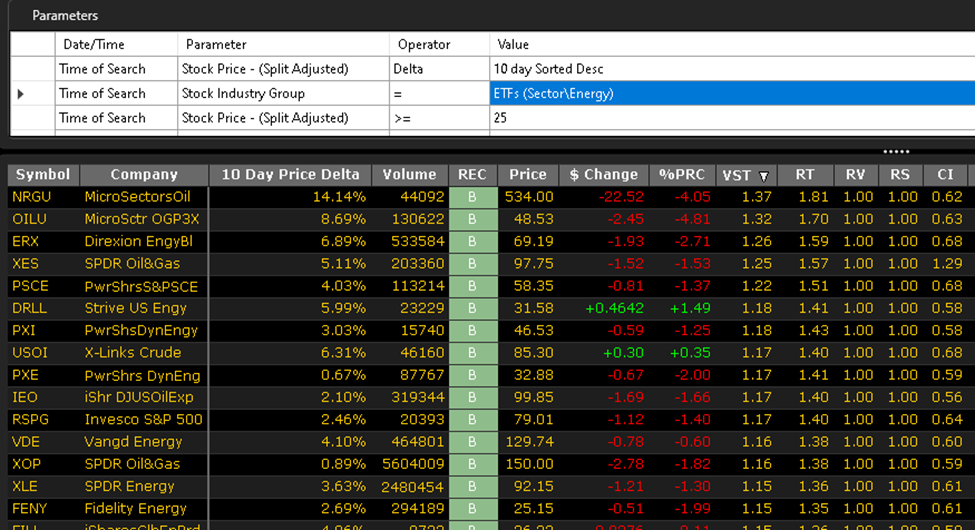

The powerful VectorVest UniSearch tool provides subscribers with over 200 pre-set (default) searches (e.g., strategies) to identify stocks/ETFs that meet specific screening criteria. The four variables in the UniSearch screen have the following descriptions: Date/Time, Parameter, Operator, and Value. Each criterion in the search requires that each of these columns be filled in with the appropriate entry.

Once any search is chosen and run, further analysis is required to determine whether any of the listed candidates are suitable for placement in a watchlist and for purchase. Most importantly, to increase the odds of a successful outcome, it is critical that any ETF considered for purchase should have a “Buy” recommendation, coupled with a Daily Color Guard market “Buy” signal, as well.

UniSearch strategies are provided for conservative, moderate, and aggressive investors/traders. Also, each preset strategy can be adjusted to change the output by adding other search criteria or changing the values currently embedded in the original strategy.

Any individual strategy selected can be used as is or altered to meet the user’s needs. Other criteria include fundamental, technical, VectorVest proprietary values (RT, RS, VST, CI, etc.), as well as user-defined customized settings. Moreover, any specific “stock” search criteria can be easily adapted to and customized for ETFs by changing the criteria settings from stock to ETFs, as follows:

Parameter Operator Value

Stock Industry Group = ETFs

Most searches provided contain only 5 to 7 lines of criteria, but the user can add or delete any criteria based on individual preferences. However, adding too many criteria or making them too restrictive (e.g., VST >=1.8) may lead to no candidates emerging. If this situation occurs, the other values should be used until a reasonable number of ETFs appear as output. Of course, market conditions and whether the market is trending higher or lower will greatly impact the number of ETFs that show up in the search results.

Pre-Set ETF Searches

UniSearch provides 30 pre-set ETF searches as a separate category, containing strategies for standard ETFs, as well as for leveraged and Contra ETFs. Subscribers should become familiar with these searches by opening each one up to see the parameters and values used. They will notice that many searches have three to four core parameters and values with a few variations. By running a dozen searches or more with slight changes in the criteria, the user will become more knowledgeable in using the tool to capture the ETFs that make the cut.

There are 32 possible ETF categories to be used in searches, including ETFs (Short), ETFs (Sector/14 choices), as well as a small number of foreign, fixed income, commodity, specialty, and capitalization size ETFs. Of course, all the 1900 ETFs in the VectorVest universe can be used if desired by the user, but that choice will include all leveraged and Contra ETFs, which will heavily populate the top rankings in any search because of their double and triple price magnification.

Common Search Criteria

Common search criteria for ETF searches would typically include:

- stock price > =$1 (or any value you prefer such as >=$10)

- stock average volume (50-day ma) >= 100000 (1000000, etc.)

- stock exchange < > P, Q, X (excludes OTC and pink sheet, mostly penny stocks)

- stock sector = ETFs (includes all ETFs + leveraged and inverse)

or

- stock industry group = ETFs (Short) if contra ETFs are of interest

or

- stock industry group = ETFs (US/LargeCap) or any other combination of the 32 ETF industry categories

- stock recommendation < > Sell (meaning no ETFs with a Sell rating, but they can have a Hold rating)

or

- stock recommendation = Buy

“Operator” column choices, in addition to the standard mathematical symbols (=, <, >, < =, > =, and < >) provided, including either new high or low price, trending (number of consecutive positive or negative days), and delta (change of certain percentage amount or percent change over a particular time period or from a specified starting date.)

Delta Criteria Result Example

The Delta operator is used to ferret out ETFs with price momentum based on any time period or percentage you select, with a descending order specified for ETF purchases and an ascending order for shorts (e.g., Contra ETFs).

As we know, the energy sector has performed exceedingly well during the past two years, as well as over the past two weeks. Let’s search for Energy ETFs to see the top-ranked ones using only three criteria. The first criterion was a share price equal to or greater than $25 a share. Second, the search was restricted to the Energy Sector. And lastly, a 10-day price Delta (descending meaning ranked from high to low) was used.

The search results are presented below (with only a portion shown in this text). There were 35 ETFs that made the cut, and 21 had buy ratings, which indicates their strength as expected. The top three ETFs were leveraged, while the remaining ones were not.

Other very useful criteria are technical tools. By adding the ProSearch add-on (one-time charge), subscribers can include any of 15 technical indicators in the search lines, either with their pre-set default values or values set by the user. These include technical indicators such as moving averages, MACD and DPO crossovers, RSI, stochastics, Bollinger Bands, ADX, and support and resistance, among others.

In summary, the UniSearch tool provides investors and traders with an exceptionally easy way to extract the “gems” in the ETF space that can be reviewed for positive chart characteristics before they are placed on watchlists, and potentially purchased at the right time for profitable trades.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment