Viasat, a satellite broadband communications company for the military and commercial markets, enjoyed a 40% boost in stock price Monday morning. This spike resulted from their deal with defense contractor L3 Harris Technologies. In total, the deal is estimated to bring in over $1.8 billion after taxes, fees, and other expenses.

The deal will result in Viasat selling its Link 16 Tactical Data Link (TDL) business. This is an integrated network designed to securely share voice-and-data communications among military aircraft, surface vessels, ground vehicles, and bases. And, this particular segment of Viasat’s business produced over $400 million in revenue over the 12-month period ending June 30. And while Viasat will certainly miss this revenue, the return on the deal is more than enough to justify it.

They’ll be able to transform their balance sheet, reduce cash interest obligations, and sharpen strategic focus. Now, the goal will turn towards continued growth opportunities in place of the Link 16 business. According to Mark Dankberg – a Viasat Executive – customers can expect Link 16 to remain a competitive, innovative, and reliable source for their future needs through L3 Harris. As for Viasat, their plan is to use the proceeds from this sale to reduce net leverage from the Inmarsat acquisition just a few months ago and focus more on areas that they feel have more synergy: Broadband Satcom services, networking, and technology cybersecurity, and an emerging portfolio of space-based services. What exactly is Viasat’s next move, though? That remains to be seen – although, one analyst believes this deal will provide Viasat with the resources to compete with Musk & SpaceX’s Starlink satellites.

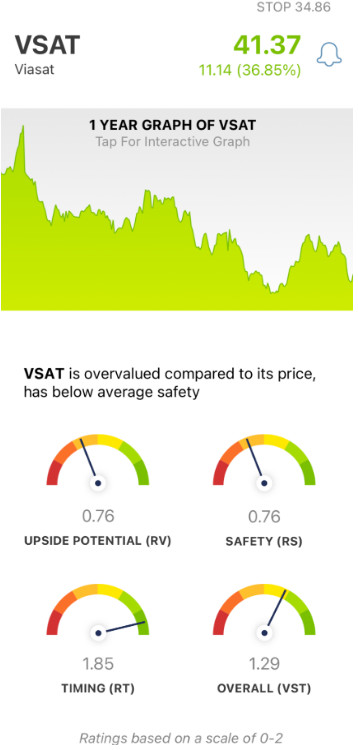

Whatever their next move is, the deal couldn’t have come at a better time. Viasat was down almost 50% over the previous year’s period before this news. They were trading at a low point of $26/share in July of this year. Fast forward to today, and the stock sits at over $40 this morning alone. Will this surge be temporary, or can investors expect this price trend to continue? Is now the time to go, or is this a matter of “if you’re reading this it’s too late”? To help investors gain a clear recommendation for their next steps, let’s look at VSAT stock through the VectorVest stock analysis system.

Despite Poor Upside Potential & Safety, VSAT Has Excellent Timing!

The VectorVest system simplifies stock analysis to help you tune out the noise and gain accurate, emotionless insights into how you should trade in the stock market.

The system consists of three easy-to-understand ratings, which sit on a scale of 0.00-2.00. These are Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). Together, these make up the overall VST rating a stock is given – and from there, the system can provide you with a buy, sell, or hold recommendation for any given stock, at any given time. And here’s the current situation for VSAT:

- Poor Upside Potential: The RV rating takes into account the long-term price appreciation potential a stock has – projected up to three years out. And, the RV rating of 0.76 for VSAT is poor, despite the prospect of what this deal could mean for them. Moreover, VectorVest calculates the company’s current value to be lower than what it’s trading right now – at $30 compared to a share price of $40

- Poor Safety: Furthermore, VSAT has poor safety with an RS rating of 0.76. This is calculated from an analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: This is where things get interesting for investors – as VSAT has excellent timing right now with an RT rating of 1.85. This rating factors in the direction, dynamic, and magnitude of a stock’s price movement. It doesn’t just take into account short-term trends, but also mid and long-term trends.

All of these ratings average together to an overall VST rating of 1.29 – which is good. However, if you want a clear buy, sell, or hold recommendation for this stock so you can make your next move with confidence, you’re in luck. You can analyze the stock free here to see how the VectorVest system works in action.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for VSAT, it is overvalued with poor upside potential and safety. However, the excellent timing it has right now may create an opportunity for investors – but you’ll need VectorVest’s help to determine the right entry and exit point.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only [offer_txt] (usually up to [saving_txt]/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.