Providence, Rhode Island-based United Natural Foods Inc. (UNFI) has fallen more than 24% in Tuesday morning’s trading session so far. The company reported fiscal 4th quarter earnings that left much to be desired, while also issuing a warning for the road ahead.

The company reported a steep net loss of $68 million for the quarter, which comes out to a loss of $1.15 per share. This time last year the net income was positive at $39 million (63 cents per share). United Natural Foods reported a 25-cent loss on an adjusted per-share basis which was better than analysts were looking for according to the consensus of a 39-cent loss.

While sales did climb incrementally to $7.417 billion from $7.273 billion this time last year, the growth wasn’t enough to meet expectations. Analysts were looking for $7.467 billion.

CEO Sandy Douglas attributes the negative results of this challenging quarter to a decrease in inflation-driven procurement gains and shrink. Shrink is typically used to refer to unsellable goods as a result of damage or spoilage – but in this case, it’s a result of theft.

Crime has been a problem for retailers in all industries, and United Natural Foods has felt these effects themselves. Organized gangs are costing companies millions of dollars in shoplifting losses.

As if the fiscal fourth-quarter earnings weren’t bad enough the company took the time to let shareholders know these challenges would persist well into the future. The first half of fiscal 2024 will be much of the same. Will things turn around after that? Only time will tell.

What we do know is that UNFI is down more than 62% in the past year, and things don’t look to be turning around anytime soon. So, where does all this leave you if you currently hold this stock? Is it time to cut losses?

We’ve uncovered 3 things that you need to see through the VectorVest stock forecasting software before you do anything else.

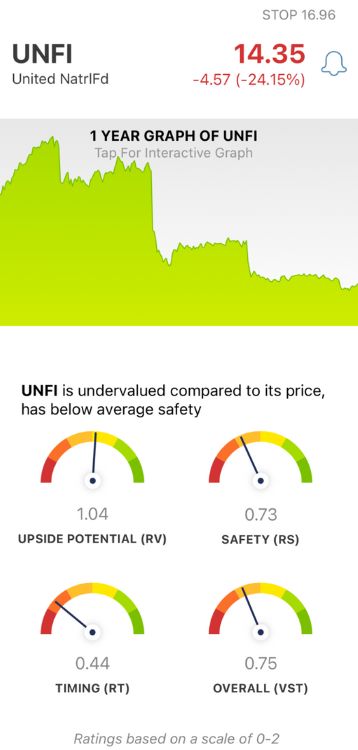

While UNFI Has Fair Upside Potential the Stock Has Poor Safety and Very Poor Timing

VectorVest is a proprietary stock rating system that helps you eliminate guesswork, emotion, and human error from your investing strategy. It’s all based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on an easy-to-understand scale of 0.00-2.00 with 1.00 being the average. The best part is that you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for UNFI:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year projection) to AAA corporate bond rates and risk. And right now, UNFI has a fair RV rating of 1.04 - just above the average. The stock is undervalued with a current value of $21.60 per share. Unfortunately, this is where the positive news ends.

- Poor Safety: The RS rating is an indicator of risk. It comes from an analysis of a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for UNFI, the RS rating of 0.73 is poor.

- Very Poor Timing: As you can see by looking at how the stock has performed in both the short and long term, UNFI has very poor timing right now. The RT rating of 0.44 reflects this. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.75 is poor for UNFI - does that confirm that you should cut your losses on this stock, though? Or, is there any reason to hold onto the hope that things will turn around?

A clear answer is just a click away at VectorVest. Get a free stock analysis today and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UNFI delivered lackluster earnings and a harrowing outlook for fiscal 2024. Shares have fallen more than 24% as a result. While the stock has fair upside potential, it has poor safety and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment