Tesla shareholders voted overwhelmingly to approve a 3-for-1 stock split – at a ratio of 815 million for and just a measly 9 million against. Stock splits are typically done in an effort to make a company’s stock more accessible to new investors. We usually view a stock split as a positive signal of growth – either in the present or the future. But is this the case with Tesla? Is this stock split good news for investors?

To help you understand what this stock split could mean, let’s look back to 2020 when Tesla last underwent a stock split. The result of this stock split announcement was a 65% increase in value – from $1,300-$2,000/share. This was the largest surge the tech giant has ever seen. But, upon the issue of the stock split, the price reset at around $460 – and over the year, doubled to around where it sits today: $844. This time, though, the hype hasn’t resulted in a surge – rather, a 6% decrease in stock price. With that said, the real impact of a stock split is felt when the split occurs – so, what does all this mean for Tesla? As one of the strongest companies in tech, our stock analysis tools are rating Tesla as a buy. Here’s why…

3 Reasons Why the VectorVest System Rates Tesla a Buy

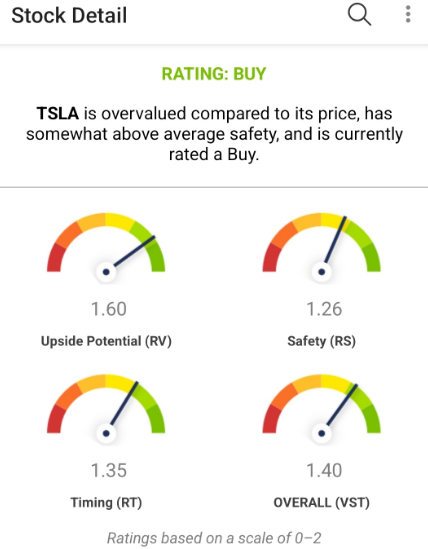

The VectorVest system is an innovative approach to analyzing stocks. The process simplifies all indicators and analysis into three simple metrics: relative value (RV), relative safety (RS), and relative timing (RT). Stocks are evaluated with these three metrics in mind and assigned a rating from 0.00-2.00 – with 1.00 making up the average. Here’s why our system is showing the stock as a buy rating:

- The upside potential is tremendous for Tesla. With a forecasted earnings growth rate of 51%, the 1-3 year horizon looks promising for Tesla. This, coupled with a sales growth rate of 42%, has earned Tesla an RV (relative value) rating of 1.60 – far above average.

- Tesla is a safe buy. Despite a poor comfort index, the company has scored an RS (relative safety) rating of 1.26. This is based on how consistent and predictable the stock is in terms of financial performance, debt-to-equity ratio, volume, longevity, volatility, and more.

- Tesla has very good upward momentum. Our RT(relative timing) rating for Tesla sits at 1.35 right now – suggesting a strong trend with plenty of momentum to sustain it.RT is calculated based on the direction, magnitude, and dynamics of the stock’s price movements.

Tesla has an impressive overall VST (Value, Safety, Timing) rating of 1.40. Tesla is one of the strongest stocks trading on the market now. Plus, a dividend is coming as a result of this stock split. Tesla typically doesn’t pay a dividend, but on August 24th, they will.

All things considered, our stock analysis tools have Tesla rated as a buy.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Tesla, it is safe, it shows great long-term upside potential, and the timing is very good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment