It was announced early this morning that Amazon is adding another Prime Day sale to their calendar. Prime Day has historically come once a year and has been the most lucrative day for the company – and its sellers. Revenue on Prime Day has even surpassed Black Friday/Cyber Monday sales in the past. This new sale is known as the “Prime Early Access Sale”, and is set to take place next month on October 11-12. It’s only available for Prime subscribers, who will gain access to hundreds of thousands of items at steep discounts.

Typically, Amazon Prime Day lands in the heat of summer – this year, it was July 12-13. So, what’s with the secondary sale? It seems with each passing year, holiday shopping is getting underway earlier and earlier. This is likely the idea Amazon had in mind with this sale, following suit of two of their main competitors: Target & Walmart. Both these companies released news of an early holiday sale in October. Further, the timing aligns with the record number of new Prime members acquired at the start of the NFL season, as Amazon Prime is the home of Thursday Night Football. Perhaps a way to capitalize on the new NFL audience.

Now, it remains to be seen how effective adding another Prime Day will be for Amazon. Analysts are skeptical as to whether this will contribute to more sales in the 4th quarter. Instead, they believe that this early holiday shopping will only take away from the frenzy that is sure to come on Black Friday/Cyber Monday – while lowering margins. Moreover, consumer spending has slowed as a result of sky-high inflation and a looming recession.

But, Amazon is looking to do whatever it takes to finish the year on a high note.

The e-commerce giant has actually had a poor year thus far, down over 30% in the last 365-day period. It’s obvious that this second prime day sale is an effort to push the stock back in the right direction. But, will this work out the way Amazon has intended? Only time will tell. While the stock enjoyed a quick 3% pump this morning, it has pulled back since the open.

What we know for sure is that the VectorVest system is capable of providing investors with a simple, emotionless form of analysis. With this stock analysis tool in your arsenal, you can tune the noise out and just get a clear buy, sell, or hold recommendation. To gain invaluable insights into Amazon stock, continue to read below as we unveil what VectorVest has to say on the matter…

Two Red Flags for Amazon Stock As Seen Through the VectorVest Lens

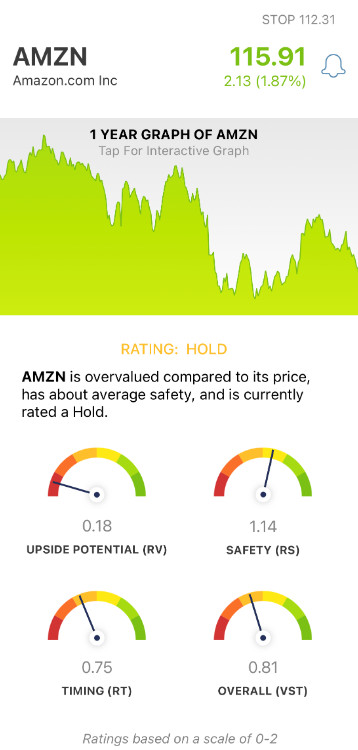

The VectorVest simplifies stock analysis for investors by boiling down all that you need to know into three simple ratings. These are relative value (RV), relative safety (RS), and relative timing. All VectorVest ratings are easy to understand, on a scale of 0.00-2.00 – with the higher end of that scale being more positive.

Together, these three ratings make up the overall VST rating a stock is given. From there, the system provides a clear buy, sell, or hold recommendation. And despite the news of another Prime Day, VectorVest doesn’t see much value in buying Amazon right now:

- Very Poor Upside Potential: The RV rating speaks to a stock’s long-term price appreciation potential up to three years out. And, the current RV rating of 0.18 is very poor for Amazon. Making matters worse, the stock is significantly overvalued at its current price of $115.75. VectorVest values it at $11.72.

- Good Safety: While the value is lacking for Amazon, it does have good safety with an RS of 1.14. This is calculated from a deep analysis of the consistency & predictability of a company’s financial performance, along with the debt to equity ratio, business longevity, and more.

- Poor Timing: You would think that news of another huge sale would pique investors’ interest and create positive price movement for Amazon stock – but that’s not been the case yet. In fact, the Relative Timing (RT) rating of 0.75 is poor – and tells us that Amazon has a negative price trend at this time.

Taking all three of these ratings into account, Amazon has a poor VST rating of 0.81. Does this mean it’s time to sell your position if you’re currently invested? Or should you wait a bit longer and see what happens over the coming weeks as Prime Early Access Sale approaches? To get a clear answer on your next steps, analyze Amazon stock free here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Amazon, it is way overvalued with poor long-term price appreciation potential. Despite good safety, it has a negative price trend with the momentum pushing the stock down further and further.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment