Robinhood Markets (HOOD) reported its fiscal first quarter results Wednesday that featured a record-breaking revenue performance field by newly acquired assets as the company sought to diversify its offerings for customers.

Shares jumped around 7% prior to the market opening but have since settled at around even on the day. They’re still up more than 5% on the week so far.

The mobile investment brokerage brought in revenue of $618 million, well north of the $553 million analysts were forecasting along with the $441 million reported this time last year.

It wasn’t just the top line either, profits improved as well. Earnings per share of 18 cents were comfortable ahead of the consensus of just 6 cents per share. This was a dramatic turnaround year over year compared to the 57 cents loss Robinhood reported in 2023.

Much of this performance can be attributed to the company’s efforts to broaden its horizons. While most are familiar with Robinhood as a stock trading app, this is just one of its offerings these days. The platform also supports retirement planning and has its own credit cards.

The company pointed out that its assets under custody climbed 65% for the quarter as equity and crypto valuations skyrocketed. Like Coinbase, Robinhood benefited from the Bitcoin boom during the first quarter.

Net deposits came in at $11.2 billion, partially fueled by bonuses offered to investors who transferred funds over to open an account. CFO Jason Warnick says that at least 75% of the company’s deposits were not related to any sort of promotion, though – a positive sign of evergreen growth.

All of this comes less than a month after Robinhood was downgraded on concerns that its valuation was too closely tied to Bitcoin. We wrote about this situation and how we still saw reason to buy HOOD at the time – but is this still the case today?

The stock has climbed 40% year to date, and we’ll help you find out if there’s room for it to keep going below. We’ve found 3 things in the VectorVest stocks software you need to see before you make your next move one way or the other.

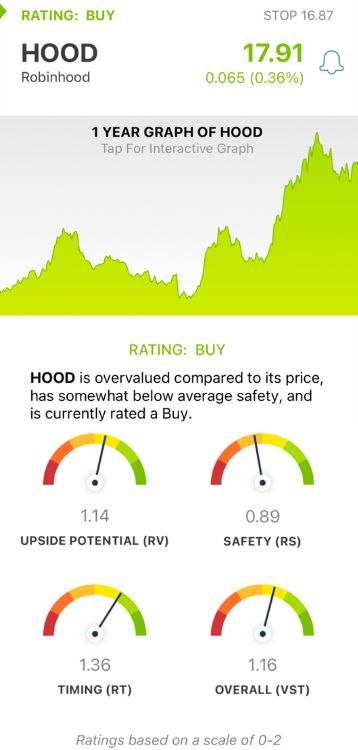

HOOD Has Good Upside Potential, Fair Safety, and Very Good Timing

VectorVest is a proprietary stock rating system that simplifies your decision-making while empowering you to win more trades. You’re given all the insights you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

Better yet, the system offers a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. This eliminates all guesswork and uncertainty from your investment strategy. As for HOOD, here’s what you need to know:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This offers far superior insights to the typical comparison of price to value alone. HOOD has a good RV rating of 1.14.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. Despite being a bit below the average, the RS rating of 0.89 is still deemed fair for HOOD.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. Reflecting the stock’s performance so far this year, HOOD has a very good RT rating of 1.36.

The overall VST rating of 1.16 is good for HOOD, and it’s still rated as a BUY today. Don’t miss out on this opportunity - make your next move with confidence and clarity with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HOOD reported record-breaking revenue in Q1 as the company diversified its business offerings and benefited from a Bitcoin bull run. The stock itself has good upside potential, fair safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment