Those looking to buy Peloton equipment and fitness gear or access to thousands of on-demand fitness classes will be excited to hear that it just got a whole lot easier. Now – the company’s offerings are available through Amazon. The fitness company struck a partnership with the e-commerce platform to grow its customer base, make their products more accessible, and increase investor confidence. On the heels of this announcement, Peloton stock soared 20% Wednesday.

Thursday was a different story. Q4 earnings missed expectations with growing customer churn, slowing engagement and difficulty signing up new members. This lowered investors’ confidence in future demand. With a stock of price of $13.48 midday Thursday, the company remains a 4 billion dollar company. VectorVest values the stock at $1.55, computed from forecasted earnings per share, forecasted earnings growth, profitability, interest and inflation rates. The VectorVest system rates the stock a hold. The stock price remains above VectorVest’sStop Price of $10.46.

For a few years now Peloton has been slowly earning a name and becoming the premier choice in home fitness equipment. The company just started to hit its stride prior to the COVID-19 pandemic – at which point sales skyrocketed. Consumers were forced to invest in their own home fitness solutions or wait for gyms to reopen – and Peloton capitalized on this. They reached a high of $171/share in January of 2021 – and since then, they’ve been on a consistent decline. The stock is down over 90% from the high, but company executives are hoping this new sales channel will spark a reversal.

This all came as the result of the company’s founder – John Foley – stepping down in February as losses continued to stack up. The new CEO – Barry McCarthy – is on a mission to stop the bleeding and make it as easy as possible to get Peloton equipment in homes around the world. The Amazon partnership is an obvious first step to making that happen. Another potential revenue driver through this partnership is live, on-demand fitness classes for Amazon Prime members. However, it remains to be seen how this partnership will evolve.

Why VectorVest’s Stock Forecasting Tools Don’t Rate Peloton a Buy

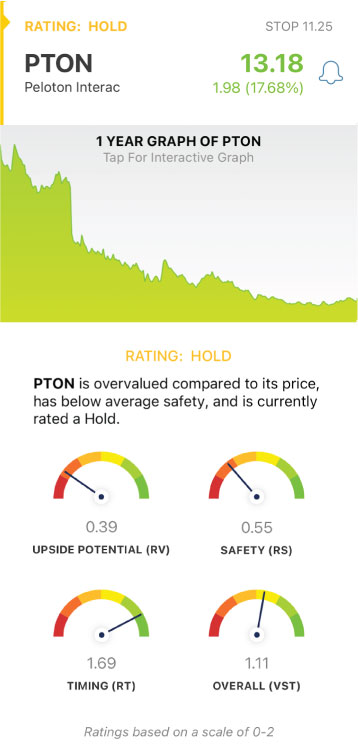

All this said, many investors remain interested in Peloton. They have developed a dominant fitness community with over 3 million subscribers. But in the VectorVest system, Peloton is still rated a hold. And, there are several key reasons why: very poor upside potential and high risk. VectorVest’s stock forecasting tools use a system to rank stocks based on three proprietary factors: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT): all three of which make up the average rating a stock is given, or its VST rating. These ratings sit on a simple scale of 0.00-2.00 – with 1.00 being the average. The closer to 2.00, the better.

The RT rating is fair at 1.04, that’s where any good news ends. The RV of 0.45 suggests very poor long-term price appreciation potential. In fact, our system suggests that the stock is currently way overvalued as it stands. All of this is coupled with a very poor forecasted earnings growth rate of -11%. Even with the news of the Amazon partnership, the future is bleak for Peloton.

Furthermore, this stock is a risky investment at this time. Relative Safety is an indication of risk – and right now, Peloton’s RS rating of 0.55 is poor – suggesting a lack of consistency and predictability in Peloton’s financial performance and business longevity. A fourth indicator our system provides is the CI (Comfort Index). This is another risk indicator which speaks to a company’s ability to withstand severe or lengthy price declines. And as you may surmise just by looking at Peloton’s 1 year chart, it has a poor CI rating of 0.17. While certain investors may see an opportunity to swing trade PTON and capitalize on this temporary trend we’re seeing, our system rates it a HOLD – with an overall VST of 0.76.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Peloton, it is overvalued with very poor upside potential, it’s unsafe, and despite excellent timing, is rated a HOLD.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Updated: 8/31/22

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment