PayPal (PYPL) profits have been under scrutiny by analysts and shareholders alike for a few months now. And after the digital payment processing firm reported its second-quarter earnings Wednesday, it appears that concern was substantiated.

Despite a strong forecast, the lackluster margins for PayPal resulted in a strong sell-off in Thursday morning’s trading session. Shares are down more than 11% so far as the company reported adjusted operating margins of 21.4%, falling from 22.7% last quarter. This was below the 22% outlook the company had forecasted previously.

The problem is in the structure of PayPal’s different business segments. While low-margin segments are growing with ease (Braintree), the higher-margin segments (PayPal-branded checkout platform) are stagnant. So while revenue may be growing steadily, profitability is falling.

The company stated that higher provisions in its credit portfolio along with stricter standards on underwriting loans have also hindered margin growth.

That being said, PayPal does expect things to improve for the current quarter. The forecasted EPS of $1.22-$1.24 is in line with the consensus of $1.22.

However, there are other challenges for the company – like the fact that CEO Dan Schulman already has one foot out the door and there is no replacement for him yet. He’s scheduled to retire at the end of the year.

While the company stated that it’s in the final stages of interviewing several outstanding candidates, the stock will remain “range bound” until the new leader takes the helm and begins making changes.

Before this news, PYPL stock was rallying in the right direction. Share prices had climbed nearly 13% in the last month before falling off a cliff this morning. Is this sell-off justified, or is this another classic case of the market overreacting to moderately unpleasant news?

If you’re currently invested in this stock or are wondering if there’s an opportunity here, keep reading below – we’ve analyzed PYPL through the VectorVest stock forecasting software and have 3 things you need to see before making your next move…

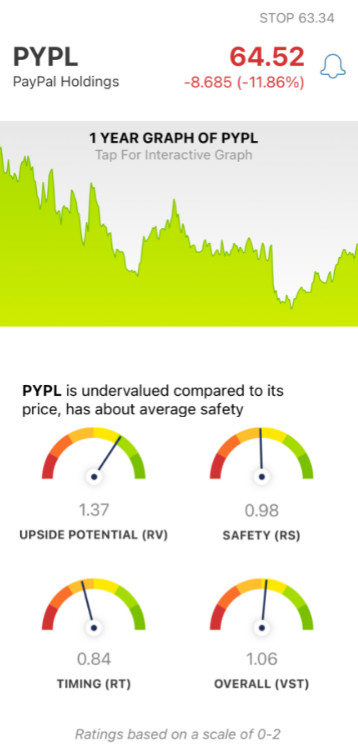

PYPL Has Very Good Upside Potential and Fair Safety, but the Timing for This Stock is Poor Right Now

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average.

This makes interpretation quick and easy, helping you win more trades with less work. But it gets better - because based on the overall VST rating for a given stock, the system issues a buy, sell, or hold recommendation. As for PYPL, here’s what you need to know:

- Very Good Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (three years out) and AAA corporate bond rates & risk. Right now, PYPL has a very good RV rating of 1.37. Plus, the stock is undervalued right now with a current value of $95.54/share.

- Fair Safety: In terms of risk, PYPL is a fairly safe stock - as evidenced by the RS rating of 0.98, which is just slightly below the average. This rating is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The biggest issue for this stock right now - beyond the profitability woes - is the negative price trend that’s formed today. The RT rating of 0.84 is poor. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors.

The overall VST rating of 1.06 is just above the average and deemed fair. But is it enough to earn the stock a “buy” recommendation - or should you hold off until the price trend reverses?

A clear answer on your next move is just a click away - get a stock analysis free at VectorVest today and remove the guesswork and emotion from your trading strategy!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While PYPL has profitability challenges and poor timing right now, the stock still has very good upside potential, and it’s fairly safe.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment