Shares of the iconic English soccer club Manchester United (MANU) enjoyed a nice 3% boost after the holidays in Tuesday morning’s trading session. The stock is up on news of Sir Jim Ratcliffe securing a 25% stake in the club.

The deal between Ratcliffe and the club was announced on Christmas Eve and sent shares higher in extended trading. He’ll acquire 25% of Class B shares and up to 25% of Class A shares as well.

Manchester United is owned by the American Glazer family, who agreed to a price of $33 a share. The family has boasted ownership since 2005 and has been exploring options for investment or outright sale since November of last year. We wrote about the rumors of a sale and what they could mean for the stock – which soared 62% at the time.

The $5.4 billion valuation this places on the club fell short of the $6 billion investors were hoping for. However, Ratcliffe will invest $300 million into the club as part of the deal. The belief is that this will contribute to the club’s Old Trafford Stadium in the future.

Another caveat is that Ineos Group, which is a chemical conglomerate owned by Ratcliffe, will accept responsibility for the club’s football operations. Not only does this mean that Ratcliffe now oversees the entirety of men’s and women’s football operations but also the club’s academies. He’ll also get 2 seats on the board.

MANU is now up nearly 7% in the past month, but down more than 8% in the past year. The stock has dropped 15% in 2023 as the club has underperformed – sitting in 8th place in the Premier League.

All that being said, is this investment by Ratcliffe and the implications that come with it reason enough to buy MANU? Not quite. We’ve analyzed this opportunity through the VectorVest stock forecasting software and have 3 things you need to see.

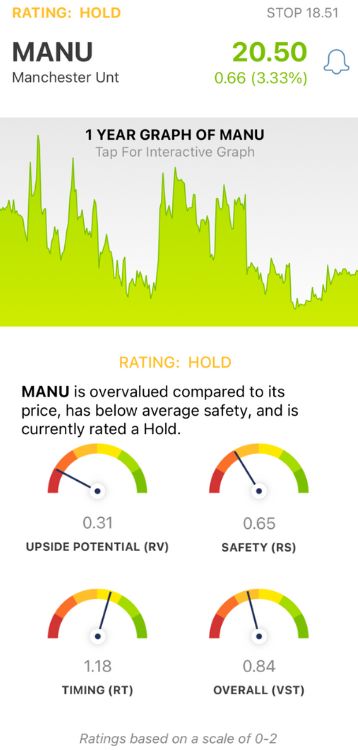

MANU Has Very Poor Upside Potential and Poor Safety Despite Good Timing

VectorVest saves you time and stress while empowering you to win more trades with less work. It does this through a proprietary stock rating system comprised of 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making for fast and effortless interpretation. You’re even offered a buy, sell, or hold recommendation for any given stock at any given time based on these ratings. As for MANU, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. MANU has a very poor RV rating of 0.31. The stock is overvalued at its current price, with a current value of just $2.05.

- Poor Safety: The RS rating is an indicator of risk. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. MANU has a poor RS rating of 0.65 right now.

- Good Timing: The one thing MANU has going for it is a positive price trend pushing the stock higher, as confirmed by the good RT rating of 1.18. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.84 is poor for MANU - and the stock is currently rated a HOLD in the VectorVest system. Learn more about this opportunity and how the system works through a stock analysis free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. MANU gained nearly 3% after billionaire Jim Ratcliffe bought a 25% stake in the club. The stock may have good timing, but its upside potential is very poor and its safety is poor as well.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $0.99 (usually up to $148/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment